Growing E-commerce Sector

The rapid expansion of the e-commerce sector in China is significantly influencing the natural language-processing market. With online retail sales projected to exceed $2 trillion in 2025, businesses are increasingly utilizing natural language-processing technologies to enhance customer interactions and streamline operations. Chatbots and virtual assistants powered by natural language-processing are becoming essential tools for e-commerce platforms, enabling them to provide personalized shopping experiences and improve customer service. This trend suggests that as e-commerce continues to flourish, the demand for natural language-processing solutions will likely increase, driving further growth in the industry. Companies that effectively integrate these technologies may gain a competitive edge, positioning themselves favorably in the evolving digital marketplace.

Rising Adoption of Smart Devices

The proliferation of smart devices in China is contributing to the growth of the natural language-processing market. As consumers increasingly adopt smartphones, smart speakers, and other connected devices, the demand for voice-activated applications is on the rise. In 2025, it is estimated that over 500 million smart devices will be in use across the country, creating a substantial market for natural language-processing technologies. These devices often rely on natural language-processing capabilities to understand and respond to user commands, making them integral to the user experience. Consequently, manufacturers and developers are likely to invest in enhancing natural language-processing functionalities, thereby driving advancements within the industry. This trend indicates a strong correlation between the adoption of smart devices and the growth of the natural language-processing market.

Expansion of Educational Technologies

The natural language-processing market in China is benefiting from the expansion of educational technologies. With the increasing emphasis on digital learning platforms, educational institutions are integrating natural language-processing tools to enhance language learning and assessment. In 2025, the market for educational technology is projected to reach $50 billion, with a notable portion dedicated to natural language-processing applications. These tools facilitate personalized learning experiences, enabling students to engage with content in a more interactive manner. Furthermore, the integration of natural language-processing in educational settings may improve language proficiency and comprehension among learners. As educational institutions continue to adopt these technologies, the natural language-processing market is likely to experience sustained growth, driven by the demand for innovative educational solutions.

Increased Investment in AI Technologies

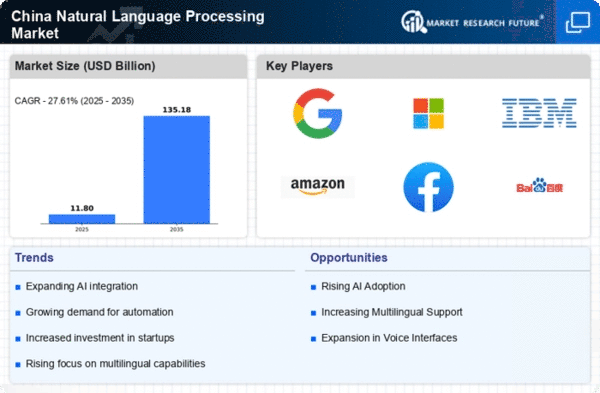

The natural language-processing market in China is experiencing a surge in investment as companies recognize the potential of artificial intelligence (AI) to enhance operational efficiency. In 2025, investments in AI technologies are projected to reach approximately $30 billion, with a significant portion allocated to natural language-processing applications. This influx of capital is likely to drive innovation and development within the industry, enabling businesses to leverage advanced algorithms for tasks such as language translation and sentiment analysis. Furthermore, the Chinese government has been actively promoting AI initiatives, which may further stimulate growth in the natural language-processing market. As organizations increasingly adopt AI-driven solutions, the demand for sophisticated natural language-processing tools is expected to rise, thereby propelling the industry forward.

Increased Focus on Data Privacy Regulations

As data privacy concerns continue to rise in China, the natural language-processing market is adapting to comply with new regulations. The implementation of stricter data protection laws is prompting companies to prioritize secure data handling practices when developing natural language-processing solutions. This shift may lead to the creation of more robust and privacy-conscious applications, which could enhance consumer trust in the technology. In 2025, it is anticipated that compliance-related investments in the natural language-processing market will increase by approximately 20%. This focus on data privacy not only addresses regulatory requirements but also positions companies to better meet the expectations of consumers who are increasingly aware of their data rights. Thus, the evolving regulatory landscape is likely to shape the future of the natural language-processing market.