Technological Integration in Healthcare

The integration of advanced technologies into healthcare practices is reshaping the minimally invasive-surgery-devices market. Innovations such as robotic-assisted surgery and enhanced imaging techniques are becoming more prevalent in Chinese hospitals. These technologies not only improve precision during surgical procedures but also enhance the overall safety and effectiveness of operations. The market for robotic surgical systems alone is anticipated to reach $1 billion by 2026 in China, reflecting a growing investment in cutting-edge surgical technologies. This trend indicates a shift towards more sophisticated surgical methods, which could potentially revolutionize patient care.

Increasing Demand for Surgical Efficiency

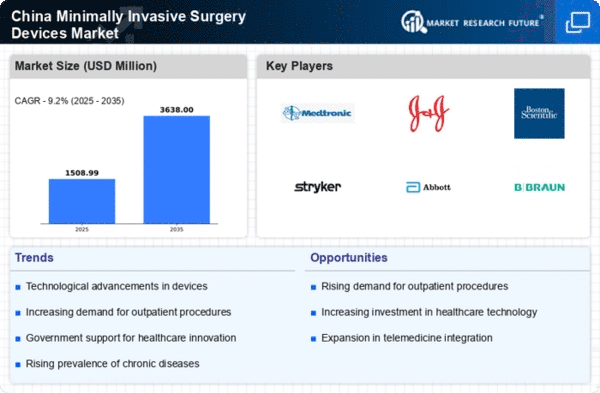

The demand for enhanced surgical efficiency is a primary driver in the minimally invasive-surgery-devices market. Surgeons and healthcare facilities in China are increasingly seeking methods that reduce operation time and improve patient outcomes. Minimally invasive techniques, which often result in shorter recovery periods and less postoperative pain, are becoming the preferred choice. According to recent data, the market for these devices is projected to grow at a CAGR of approximately 10% over the next five years. This growth is indicative of a broader trend towards optimizing surgical procedures, which is likely to continue as healthcare providers strive to improve operational efficiency and patient satisfaction.

Aging Population and Rising Chronic Diseases

China's aging population is a significant factor influencing the minimally invasive-surgery-devices market. As the demographic shifts towards an older population, the prevalence of chronic diseases such as cardiovascular conditions and diabetes increases. This demographic trend necessitates more surgical interventions, many of which can be performed using minimally invasive techniques. The World Health Organization estimates that by 2030, the number of individuals aged 60 and above in China will reach 487 million, further driving the demand for advanced surgical solutions. Consequently, the market is expected to expand as healthcare systems adapt to the needs of an aging society.

Government Initiatives and Healthcare Investments

Government initiatives aimed at improving healthcare infrastructure are playing a crucial role in the growth of the minimally invasive-surgery-devices market. The Chinese government has been increasing its healthcare budget, with a focus on modernizing hospitals and expanding access to advanced medical technologies. In 2025, the healthcare expenditure is projected to reach approximately $1 trillion, which will likely facilitate the adoption of minimally invasive surgical techniques. This investment not only enhances the availability of these devices but also encourages research and development, fostering innovation within the market.

Rising Healthcare Expenditure and Insurance Coverage

The increase in healthcare expenditure in China is a significant driver for the minimally invasive-surgery-devices market. As disposable incomes rise, patients are more willing to invest in advanced medical treatments. Furthermore, the expansion of health insurance coverage is making minimally invasive procedures more accessible to a broader population. Reports indicate that healthcare spending in China is expected to grow by 6% annually, which will likely support the adoption of minimally invasive surgical techniques. This trend suggests a shift towards prioritizing quality healthcare, thereby enhancing the market's growth potential.