Advancements in Genomic Research

The life science-analytics market is significantly influenced by advancements in genomic research within China. The country's focus on precision medicine and personalized healthcare is driving the need for advanced analytics solutions capable of interpreting complex genomic data. By 2025, the market for genomic analytics is expected to exceed $10 billion, with a compound annual growth rate (CAGR) of approximately 20%. This growth is indicative of the increasing reliance on analytics to facilitate breakthroughs in genetic research and therapy development. As a result, the life science-analytics market is likely to benefit from innovations that enhance the understanding of genetic factors in disease, thereby improving treatment strategies.

Regulatory Support for Innovation

The regulatory environment in China is evolving to support innovation within the life science-analytics market. Recent initiatives by the government aim to streamline approval processes for new analytics technologies, thereby encouraging investment and development. By 2025, it is expected that regulatory frameworks will become more conducive to the introduction of innovative analytics solutions, potentially reducing time-to-market for new products by up to 30%. This supportive regulatory landscape is likely to attract both domestic and international players to the market, fostering competition and driving technological advancements. As a result, the life science-analytics market is positioned for growth, with an increasing array of analytics tools becoming available to researchers and healthcare providers.

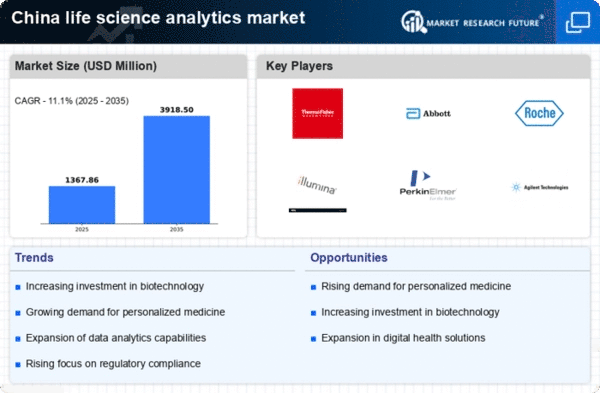

Rising Investment in Biotechnology

The life science-analytics market in China is experiencing a surge in investment, particularly in biotechnology. This trend is driven by the government's commitment to enhancing healthcare infrastructure and promoting innovation. In 2025, investments in biotechnology are projected to reach approximately $50 billion, reflecting a growth rate of around 15% annually. This influx of capital is likely to facilitate the development of advanced analytics tools that can process vast amounts of biological data, thereby improving research outcomes. As a result, the life science-analytics market is expected to expand significantly, with companies increasingly leveraging analytics to drive drug discovery and development processes.

Growing Demand for Data-Driven Decision Making

In the context of the life science-analytics market, there is a notable shift towards data-driven decision making among healthcare providers and pharmaceutical companies in China. Organizations are increasingly recognizing the value of analytics in optimizing operations and enhancing patient outcomes. By 2025, it is estimated that over 70% of healthcare institutions will adopt analytics solutions to inform clinical decisions. This trend is likely to propel the demand for sophisticated analytics platforms that can integrate diverse data sources, thus fostering a more efficient healthcare ecosystem. Consequently, the life science-analytics market is poised for robust growth as stakeholders seek to harness data for strategic advantages.

Increased Collaboration Between Academia and Industry

Collaboration between academic institutions and industry players is becoming a pivotal driver for the life science-analytics market in China. This synergy fosters innovation and accelerates the translation of research findings into practical applications. In 2025, it is anticipated that partnerships will lead to the establishment of over 100 new research initiatives focused on analytics in life sciences. Such collaborations are likely to enhance the development of cutting-edge analytics tools and methodologies, thereby enriching the market landscape. The life science-analytics market stands to gain from these partnerships, as they facilitate knowledge exchange and resource sharing, ultimately driving advancements in healthcare solutions.