Focus on Recycling and Sustainability

The lead acid-battery market is increasingly focusing on recycling and sustainability practices in China. With growing environmental concerns, the government is implementing stricter regulations on battery disposal and promoting recycling initiatives. Lead acid batteries are among the most recycled products globally, with a recycling rate exceeding 95%. This emphasis on sustainability not only enhances the market's reputation but also reduces raw material costs for manufacturers. In 2025, the recycling market for lead acid batteries in China is projected to reach $5 billion, indicating a strong commitment to sustainable practices within the lead acid-battery market.

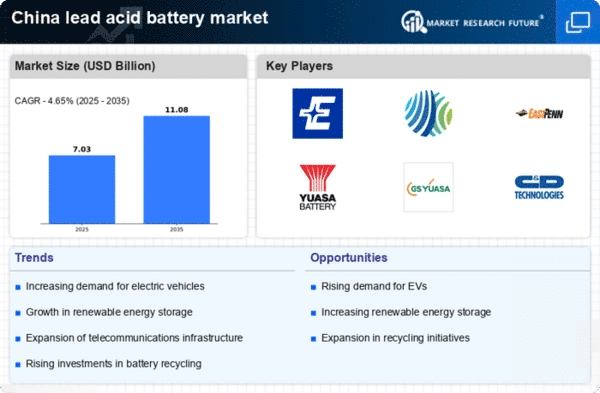

Growth in Electric Vehicle Production

The lead acid-battery market is poised for growth as the electric vehicle (EV) sector expands in China. With the government's commitment to promoting electric mobility, the production of EVs is expected to increase significantly. Lead acid batteries are commonly used in various types of electric vehicles, particularly in hybrid models and as auxiliary power sources. In 2025, the EV market in China is anticipated to reach a valuation of $200 billion, with lead acid batteries playing a crucial role in supporting this growth. This burgeoning demand for electric vehicles is likely to bolster the lead acid-battery market, as manufacturers seek reliable and cost-effective battery solutions.

Infrastructure Development Initiatives

The lead acid-battery market is benefiting from extensive infrastructure development initiatives across China. The government's focus on enhancing transportation networks, energy distribution systems, and urban development projects is driving the demand for reliable power sources. Lead acid batteries are widely utilized in backup power systems, uninterruptible power supplies, and various industrial applications. As infrastructure projects continue to expand, the lead acid-battery market is expected to see a corresponding increase in demand. In 2025, infrastructure spending in China is projected to exceed $1 trillion, creating a favorable environment for the lead acid-battery market to thrive.

Increased Adoption in Telecommunications

The lead acid-battery market is witnessing increased adoption in the telecommunications sector in China. As the demand for uninterrupted communication services grows, telecom companies are investing in reliable power backup solutions. Lead acid batteries are favored for their ability to provide consistent power supply to critical infrastructure, such as cell towers and data centers. In 2025, the telecommunications market in China is expected to reach $150 billion, with a substantial portion allocated to power backup systems. This trend suggests a promising outlook for the lead acid-battery market, as telecom operators seek dependable energy solutions to support their operations.

Rising Demand for Renewable Energy Storage

The lead acid-battery market is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources in China. As the country aims to enhance its energy security and reduce carbon emissions, the integration of renewable energy systems, such as solar and wind, necessitates efficient energy storage solutions. Lead acid batteries, known for their cost-effectiveness and reliability, are being favored for energy storage applications. In 2025, the market for energy storage systems in China is projected to reach approximately $10 billion, with lead acid batteries capturing a significant share. This trend indicates a robust growth trajectory for the lead acid-battery market, driven by the need for sustainable energy solutions.