Rising Adoption in Corporate Sector

The corporate sector in China is increasingly adopting laser projectors for presentations and meetings, driven by the need for high-quality visuals and enhanced productivity. The laser projector market is experiencing a notable shift as businesses prioritize advanced display technologies. In 2025, the corporate segment is projected to account for approximately 35% of the total market share, reflecting a growing preference for laser projectors over traditional alternatives. This trend is likely fueled by the demand for reliable and vibrant projection solutions that can cater to large audiences. Furthermore, the integration of smart technologies in laser projectors, such as wireless connectivity and interactive features, appears to enhance their appeal in corporate environments. As companies continue to invest in modernizing their meeting spaces, the laser projector market is expected to benefit significantly from this trend.

Increased Investment in Entertainment

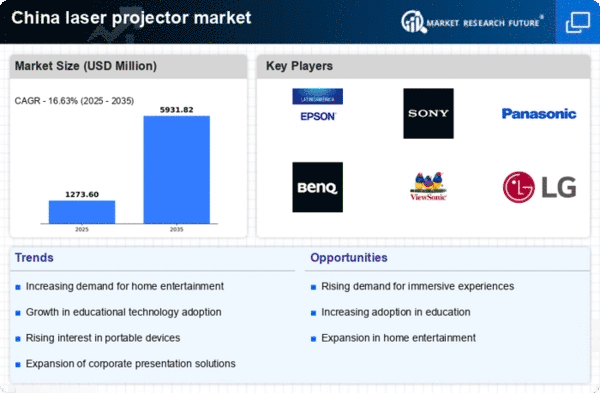

The entertainment industry in China is witnessing a surge in investment in advanced projection technologies, particularly laser projectors. This trend is largely attributed to the growing demand for high-definition visuals in cinemas, theaters, and live events. The laser projector market is projected to grow at a CAGR of around 15% from 2025 to 2030, driven by the need for superior image quality and color accuracy. As entertainment venues seek to enhance the viewer experience, the adoption of laser projectors is becoming more prevalent. Additionally, the rise of immersive experiences, such as virtual reality and augmented reality, is likely to further propel the demand for high-performance projection systems. Consequently, the laser projector market is positioned to thrive as entertainment providers invest in cutting-edge technologies to attract audiences.

Government Initiatives for Smart Cities

The Chinese government is actively promoting the development of smart cities, which is likely to have a positive impact on the laser projector market. As part of this initiative, there is an increasing focus on integrating advanced technologies into urban infrastructure, including public spaces and educational institutions. The laser projector market is expected to benefit from government funding and support for projects that enhance urban living through innovative display solutions. In 2025, it is estimated that around 20% of the market growth will be driven by public sector investments in smart city projects. This includes the installation of laser projectors in public areas for information dissemination and community engagement. As cities evolve into smart environments, the demand for efficient and high-quality projection systems is anticipated to rise, further bolstering the laser projector market.

Growing E-commerce and Online Education

The rise of e-commerce and online education platforms in China is contributing to the expansion of the laser projector market. As educational institutions and businesses increasingly adopt digital learning tools, the demand for high-quality projection systems is on the rise. In 2025, the online education sector is projected to account for approximately 25% of the laser projector market, as institutions seek to enhance remote learning experiences. Laser projectors offer superior image clarity and brightness, making them ideal for virtual classrooms and webinars. Furthermore, the convenience of e-commerce platforms allows consumers to access a wider range of laser projector options, driving competition and innovation within the market. This trend suggests that the laser projector market will continue to grow as educational and commercial entities prioritize effective visual communication in their digital strategies.

Focus on Sustainability and Eco-Friendly Solutions

Sustainability is becoming a key consideration in the laser projector market, particularly in China, where environmental concerns are gaining prominence. Manufacturers are increasingly focusing on developing eco-friendly laser projectors that consume less energy and have a longer lifespan compared to traditional projectors. This shift is likely to resonate with environmentally conscious consumers and businesses, potentially driving market growth. In 2025, it is estimated that around 30% of the laser projector market will be attributed to energy-efficient models. Additionally, government regulations promoting energy conservation may further incentivize the adoption of sustainable technologies. As the demand for eco-friendly solutions continues to rise, the laser projector market is expected to adapt by offering products that align with these values, thereby attracting a broader customer base.