Increased Investment in Smart Classrooms

The Italian education sector is witnessing a transformation with the rise of smart classrooms, which is driving the laser projector market. Educational institutions are increasingly investing in advanced technologies to enhance learning experiences. Laser projectors are favored for their ability to deliver high-quality visuals and interactive capabilities, making lessons more engaging. The laser projector market is expected to see a growth rate of approximately 14% as schools and universities adopt these technologies. Furthermore, government initiatives aimed at modernizing educational infrastructure are likely to provide additional support for this trend, encouraging the integration of laser projectors in classrooms across Italy.

Technological Advancements in Projection

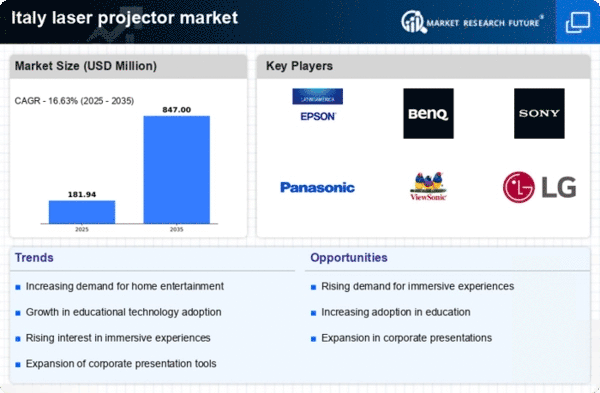

The laser projector market in Italy is experiencing a surge due to rapid technological advancements. Innovations in laser technology have led to enhanced image quality, brightness, and color accuracy, making these projectors increasingly appealing for various applications. The introduction of 4K resolution and high dynamic range (HDR) capabilities has further elevated the user experience. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the demand for high-performance projectors in sectors such as education, corporate, and entertainment. The laser projector market is thus positioned to benefit from these advancements, as consumers seek superior visual experiences.

Growing Demand for Eco-Friendly Solutions

In recent years, there has been a notable shift towards eco-friendly technologies in Italy, influencing the laser projector market. Laser projectors are recognized for their energy efficiency and reduced environmental impact compared to traditional lamp-based projectors. This aligns with Italy's commitment to sustainability and reducing carbon footprints. The laser projector market is likely to see increased adoption as businesses and educational institutions prioritize environmentally responsible solutions. Furthermore, the long lifespan of laser projectors, often exceeding 20,000 hours, contributes to lower waste and maintenance costs, making them an attractive option for consumers. This trend may lead to a market growth rate of around 12% in the coming years.

Rising Popularity of Home Theater Systems

The trend of creating home theater systems in Italy is contributing to the growth of the laser projector market. As consumers seek immersive viewing experiences, laser projectors are becoming a preferred choice due to their ability to produce large images with exceptional clarity. The laser projector market is likely to benefit from this consumer shift, as more households invest in home entertainment solutions. Market analysis indicates that the home entertainment segment is projected to grow by 11% annually, driven by the demand for high-quality visual experiences. This trend suggests a promising future for laser projectors as they become integral to home theater setups.

Expansion of the Event and Entertainment Sector

The event and entertainment sector in Italy is expanding, which is positively impacting the laser projector market. With an increase in concerts, exhibitions, and corporate events, there is a growing need for high-quality projection solutions. Laser projectors offer superior brightness and clarity, making them ideal for large venues and outdoor events. The laser projector market is likely to benefit from this trend, as event organizers seek reliable and high-performance equipment. According to industry reports, the event sector is expected to grow by 10% annually, further driving demand for advanced projection technologies. This growth presents a significant opportunity for manufacturers and suppliers within the laser projector market.