Emergence of Edge Computing

The rise of edge computing is emerging as a transformative driver for the iot telecom-services market in China. By processing data closer to the source, edge computing reduces latency and bandwidth usage, which is particularly beneficial for IoT applications requiring real-time responses. This technology is gaining traction in sectors such as healthcare, transportation, and smart cities, where immediate data processing is critical. As organizations increasingly adopt edge computing solutions, the demand for telecom services that can support these infrastructures is expected to grow. Analysts suggest that the integration of edge computing with IoT could lead to a market expansion of approximately 15% over the next few years. This trend not only enhances the efficiency of IoT applications but also positions telecom service providers as key players in the evolving landscape of the iot telecom-services market.

Expansion of 5G Infrastructure

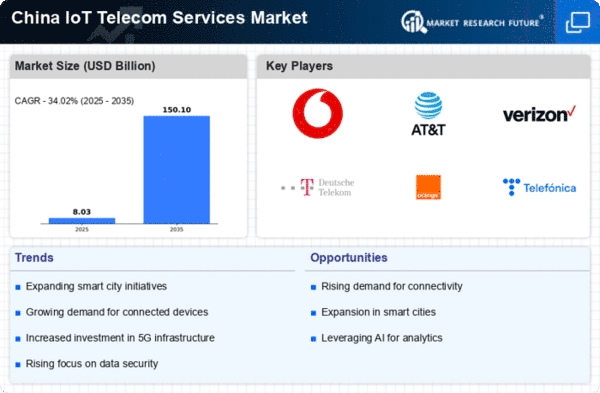

The rapid deployment of 5G infrastructure in China is a pivotal driver for the iot telecom-services market. With the government investing heavily in 5G technology, the number of 5G base stations is projected to exceed 1 million by the end of 2025. This expansion facilitates enhanced connectivity and lower latency, which are crucial for IoT applications. As a result, industries such as manufacturing, healthcare, and transportation are increasingly adopting IoT solutions, thereby driving demand for telecom services. The integration of 5G technology is expected to boost the market's growth rate, potentially reaching a CAGR of 25% over the next five years. This infrastructure development not only supports existing IoT applications but also paves the way for innovative services, further propelling the iot telecom-services market in China.

Rising Demand for Smart Devices

The proliferation of smart devices in China is a crucial driver for the iot telecom-services market. With an increasing number of households adopting smart home technologies, the demand for reliable telecom services is surging. Reports indicate that the number of connected devices in China is expected to reach 1.5 billion by 2025, creating a substantial need for efficient data transmission and connectivity solutions. This trend is further supported by the growing consumer preference for automation and remote monitoring capabilities. Consequently, telecom service providers are compelled to enhance their offerings to cater to this expanding market. The rise in smart device adoption not only fuels the demand for IoT services but also encourages innovation within the iot telecom-services market, as companies strive to deliver seamless connectivity and enhanced user experiences.

Increased Focus on Industrial IoT

The industrial sector in China is increasingly embracing IoT technologies, which serves as a significant driver for the iot telecom-services market. Industries such as manufacturing, logistics, and energy are leveraging IoT solutions to optimize operations and improve efficiency. The market for industrial IoT is projected to grow at a CAGR of 20% over the next five years, driven by the need for real-time data analytics and automation. Companies are investing in IoT-enabled devices and platforms to enhance productivity and reduce operational costs. This shift towards digital transformation in industrial processes necessitates robust telecom services to support the vast amount of data generated. As a result, the iot telecom-services market is likely to experience substantial growth, with increased demand for connectivity solutions tailored to industrial applications.

Government Initiatives and Support

The Chinese government plays a significant role in fostering the iot telecom-services market through various initiatives and policies. Programs aimed at promoting smart city development and digital transformation are gaining momentum, with substantial funding allocated to support IoT projects. For instance, the 'Made in China 2025' initiative emphasizes the integration of IoT technologies in manufacturing processes. This governmental backing is likely to stimulate investment in telecom services, as businesses seek to align with national strategies. Furthermore, the establishment of regulatory frameworks to ensure interoperability and security in IoT applications enhances market confidence. As a result, the iot telecom-services market is expected to witness robust growth, with projections indicating a potential increase in market size by 30% over the next few years.