Rising Labor Costs

The industrial automation-services market in China is experiencing a notable shift due to rising labor costs. As wages increase, manufacturers are compelled to seek automation solutions to maintain competitiveness. This trend is particularly evident in sectors such as electronics and automotive, where labor costs have surged by approximately 10% annually. Consequently, companies are investing in automation technologies to enhance productivity and reduce reliance on manual labor. The integration of robotics and automated systems is becoming essential for operational efficiency. This driver is likely to propel the growth of the industrial automation-services market, as businesses strive to optimize their processes and mitigate the impact of escalating labor expenses.

Technological Advancements

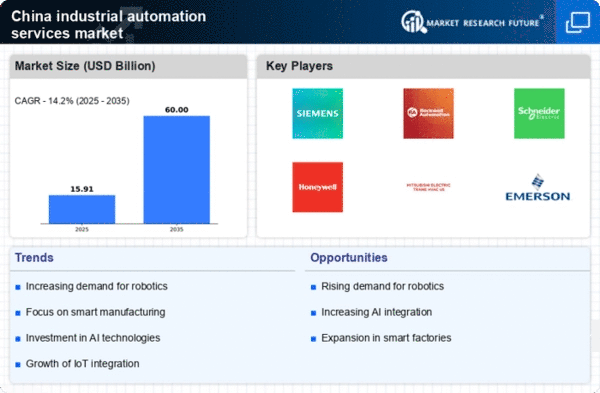

Technological advancements are significantly influencing the industrial automation-services market in China. Innovations in robotics, artificial intelligence, and the Internet of Things (IoT) are driving the adoption of automation solutions across various industries. For example, the integration of IoT in manufacturing processes allows for real-time monitoring and data analysis, enhancing operational efficiency. The market for industrial automation services is projected to reach $30 billion by 2026, reflecting a compound annual growth rate (CAGR) of 12%. This growth is indicative of the increasing reliance on advanced technologies to streamline operations and improve productivity. As such, the industrial automation-services market is poised for substantial growth driven by these technological advancements.

Increased Demand for Customization

The industrial automation-services market in China is witnessing an increased demand for customization in manufacturing processes. As consumer preferences evolve, manufacturers are compelled to offer tailored products, necessitating flexible automation solutions. This trend is particularly pronounced in industries such as consumer electronics and textiles, where customization is key to meeting market demands. Companies are investing in automation services that allow for adaptable production lines capable of handling diverse product specifications. This shift towards customization is expected to drive the growth of the industrial automation-services market, as businesses seek to enhance their responsiveness to consumer needs and improve overall efficiency.

Government Initiatives and Policies

Government initiatives play a pivotal role in shaping the industrial automation-services market in China. The Chinese government has implemented various policies aimed at promoting advanced manufacturing and automation technologies. For instance, the 'Made in China 2025' initiative emphasizes the importance of automation in enhancing industrial capabilities. This policy framework encourages investments in automation services, leading to a projected growth rate of 15% in the sector over the next five years. Additionally, subsidies and tax incentives for companies adopting automation solutions further stimulate market expansion. As a result, the industrial automation-services market is likely to benefit from these supportive governmental measures.

Focus on Quality and Safety Standards

The industrial automation-services market in China is increasingly influenced by a focus on quality and safety standards. As industries strive to enhance product quality and ensure compliance with stringent regulations, the adoption of automation solutions becomes imperative. Automation technologies facilitate consistent quality control and reduce the likelihood of human error, thereby improving safety outcomes. The market is projected to grow by 8% annually as companies prioritize investments in automation services that align with quality and safety requirements. This emphasis on standards is likely to drive the industrial automation-services market, as businesses recognize the value of automation in achieving compliance and enhancing product reliability.