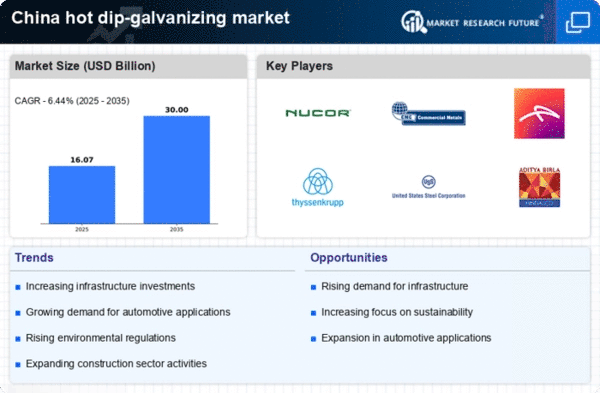

The hot dip-galvanizing market in China is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Nucor Corporation (US), ArcelorMittal (LU), and Thyssenkrupp AG (DE) are actively pursuing strategies that emphasize technological advancements and operational efficiencies. Nucor Corporation (US), for instance, has focused on enhancing its production capabilities through investments in advanced galvanizing technologies, which not only improve product quality but also reduce environmental impact. Similarly, ArcelorMittal (LU) has been leveraging its The hot dip-galvanizing market presence in Asia, indicating a strategic focus on regional growth. Thyssenkrupp AG (DE) appears to be concentrating on digital transformation initiatives, which may enhance operational efficiencies and customer engagement, thereby shaping the competitive dynamics of the market.The business tactics employed by these companies reflect a moderately fragmented market structure, where localized manufacturing and supply chain optimization are pivotal. The collective influence of these key players suggests a trend towards consolidation, as companies seek to enhance their competitive edge through strategic collaborations and technological investments. This fragmentation allows for niche players to emerge, yet the dominance of larger firms continues to dictate market trends and pricing strategies.

In October Nucor Corporation (US) announced a strategic partnership with a leading technology firm to develop AI-driven solutions for optimizing galvanizing processes. This move is likely to enhance production efficiency and reduce operational costs, positioning Nucor as a frontrunner in adopting cutting-edge technologies within the market. The integration of AI into manufacturing processes could potentially revolutionize the way hot dip-galvanizing is conducted, leading to improved product quality and sustainability.

In September ArcelorMittal (LU) unveiled plans to invest €500 million in expanding its galvanizing facilities in China. This investment is indicative of the company's commitment to increasing its production capacity and meeting the growing demand for galvanized products in the region. By enhancing its operational footprint, ArcelorMittal is likely to strengthen its competitive position and respond effectively to market dynamics.

In August Thyssenkrupp AG (DE) launched a new digital platform aimed at streamlining customer interactions and improving service delivery in the hot dip-galvanizing sector. This initiative reflects a broader trend towards digitalization, which is becoming increasingly important in enhancing customer experience and operational efficiency. By prioritizing digital solutions, Thyssenkrupp may gain a competitive advantage in a market that is rapidly evolving towards technology-driven operations.

As of November the competitive trends in the hot dip-galvanizing market are heavily influenced by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and enhance supply chain reliability. The shift from price-based competition to a focus on technological differentiation and sustainable practices is likely to define the future landscape of the market. Companies that can effectively leverage these trends will likely emerge as leaders, driving the evolution of competitive strategies in the hot dip-galvanizing sector.