Advancements in Network Infrastructure

The high performance-computing-as-a-service market in China is benefiting from advancements in network infrastructure, which are enhancing the accessibility and efficiency of computing resources. The rollout of 5G technology and improvements in fiber-optic networks are facilitating faster data transfer rates and lower latency, which are critical for high performance computing applications. These enhancements enable organizations to leverage cloud-based computing services more effectively, thereby driving demand for high performance computing solutions. As network capabilities continue to evolve, it is anticipated that the market will experience accelerated growth, with estimates suggesting a potential increase in user adoption rates by up to 30% over the next few years.

Government Initiatives and Investments

The Chinese government is actively promoting the development of the high performance-computing-as-a-service market through various initiatives and investments. Policies aimed at fostering technological innovation and digital transformation are being implemented, with significant funding allocated to research and development in high performance computing. For example, the government has set ambitious targets for supercomputing capabilities, aiming to enhance national competitiveness in this domain. This strategic focus is expected to attract both domestic and international players to invest in high performance computing services, thereby expanding the market landscape. The government's commitment to building a robust digital infrastructure is likely to create a conducive environment for the growth of the high performance-computing-as-a-service market, potentially leading to a market valuation exceeding $10 billion by 2027.

Emergence of Industry-Specific Solutions

The high performance-computing-as-a-service market is witnessing the emergence of industry-specific solutions tailored to meet the unique needs of various sectors in China. As industries such as automotive, aerospace, and pharmaceuticals increasingly adopt high performance computing, service providers are developing specialized offerings that cater to specific computational requirements. For instance, automotive companies are utilizing high performance computing for simulations and design optimization, while pharmaceutical firms leverage it for drug discovery processes. This trend not only enhances the efficiency of operations but also fosters innovation within these industries. The growing customization of high performance computing services is likely to attract a broader range of clients, potentially expanding the market's reach and driving further growth.

Rising Need for Cost-Effective Solutions

Organizations in China are increasingly seeking cost-effective solutions to meet their computing needs, which is driving the growth of the high performance-computing-as-a-service market. Traditional high performance computing setups often require substantial capital investment and ongoing maintenance costs. In contrast, the service model allows businesses to access powerful computing resources on a pay-as-you-go basis, significantly reducing upfront expenses. This shift is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the financial resources for extensive infrastructure. As a result, the market is witnessing a growing adoption of high performance computing services, with projections indicating that the segment could account for over 40% of the overall computing market in China by 2026.

Growing Demand for Data-Intensive Applications

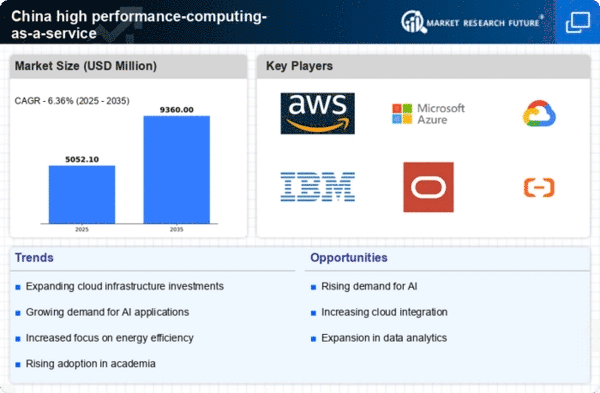

The high performance-computing-as-a-service market in China is experiencing a surge in demand driven by the proliferation of data-intensive applications. Industries such as finance, healthcare, and manufacturing are increasingly relying on advanced computing capabilities to process vast amounts of data. For instance, the financial sector utilizes high performance computing for real-time risk assessment and algorithmic trading, while healthcare leverages it for genomic research and personalized medicine. This trend is reflected in the market's projected growth, with estimates suggesting a compound annual growth rate (CAGR) of approximately 25% over the next five years. As organizations seek to enhance their operational efficiency and decision-making processes, the reliance on high performance computing services is likely to intensify, further propelling the market forward.