Regulatory Compliance and Standards

Regulatory compliance plays a pivotal role in shaping the China healthcare cold chain logistics market. The government has established stringent guidelines to ensure the safe transportation and storage of temperature-sensitive products. The National Medical Products Administration (NMPA) has implemented regulations that mandate specific temperature ranges for various pharmaceuticals, which necessitates robust cold chain logistics solutions. As of January 2026, compliance with these regulations is not merely a legal obligation but also a competitive advantage for logistics providers. Companies that invest in compliant cold chain systems are likely to gain market share, as healthcare providers increasingly prioritize partnerships with reliable logistics firms. The emphasis on regulatory adherence is expected to drive investments in advanced cold chain technologies, further propelling the growth of the industry.

Expansion of E-commerce in Healthcare

The rapid expansion of e-commerce in the healthcare sector is reshaping the China healthcare cold chain logistics market. Online pharmacies and health product retailers are increasingly utilizing cold chain logistics to ensure the safe delivery of temperature-sensitive products directly to consumers. As of January 2026, the e-commerce healthcare market in China is projected to surpass USD 50 billion, creating a substantial demand for efficient cold chain solutions. This trend is further fueled by changing consumer preferences, as patients seek convenient access to medications and health products. Consequently, logistics providers are adapting their operations to accommodate the unique challenges posed by e-commerce, such as last-mile delivery and real-time tracking. The integration of cold chain logistics into e-commerce platforms is likely to enhance customer satisfaction and drive growth in the healthcare logistics sector.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver of the China healthcare cold chain logistics market. The Chinese government has recognized the importance of a robust cold chain infrastructure to support the growing healthcare sector. As of January 2026, significant investments are being made in building temperature-controlled warehouses and transportation networks across the country. This infrastructure development is essential for ensuring the safe and efficient distribution of pharmaceuticals and biologics. Moreover, the establishment of specialized cold chain facilities in key regions is expected to enhance the overall logistics capabilities, thereby reducing delivery times and costs. The focus on infrastructure improvement aligns with the government's broader healthcare initiatives, which aim to enhance access to quality healthcare services for the population. This investment trend is likely to sustain the growth momentum of the cold chain logistics market in China.

Growing Demand for Biologics and Vaccines

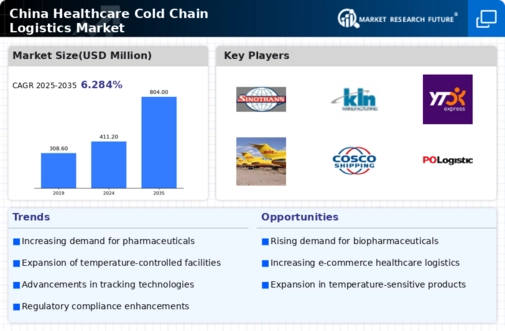

The increasing demand for biologics and vaccines is significantly influencing the China healthcare cold chain logistics market. With the rise in chronic diseases and an aging population, the need for biologics, which often require stringent temperature controls, is on the rise. In 2025, the market for biologics in China was estimated to be worth over USD 30 billion, indicating a robust growth trajectory. This surge in demand necessitates an efficient cold chain logistics system to ensure the safe delivery of these products. Additionally, the Chinese government is actively promoting vaccination programs, further amplifying the need for reliable cold chain solutions. As a result, logistics providers are compelled to enhance their capabilities to meet the growing requirements of the healthcare sector, thereby driving the overall growth of the cold chain logistics market.

Technological Advancements in Cold Chain Solutions

The China healthcare cold chain logistics market is experiencing a notable transformation due to rapid technological advancements. Innovations such as IoT-enabled temperature monitoring systems and automated storage solutions are enhancing the efficiency and reliability of cold chain operations. For instance, the integration of real-time tracking systems allows for precise temperature control, which is crucial for maintaining the integrity of sensitive pharmaceuticals. As of 2025, the market for cold chain logistics in China is projected to reach approximately USD 10 billion, driven by these technological improvements. Furthermore, the adoption of blockchain technology is anticipated to enhance traceability and transparency in the supply chain, thereby fostering trust among stakeholders. This technological evolution not only streamlines operations but also aligns with the increasing regulatory demands for stringent temperature control in the healthcare sector.