Emergence of Smart Cities

The development of smart cities in China is driving the growth of the grid computing market. As urban areas become more interconnected, the need for efficient data processing and resource management becomes critical. Grid computing technologies provide the necessary infrastructure to support smart city applications, such as traffic management, energy distribution, and public safety. In 2025, investments in smart city initiatives are projected to reach $1 trillion, creating substantial opportunities for the grid computing market. This trend indicates a shift towards more sustainable urban living, where grid computing plays a vital role in optimizing city operations and enhancing the quality of life for residents.

Increased Focus on Cybersecurity

With the rise of cyber threats, the grid computing market in China is witnessing an increased focus on cybersecurity measures. Organizations are recognizing the importance of securing their data and computing resources, leading to a growing demand for grid computing solutions that incorporate advanced security features. By 2025, the cybersecurity market in China is expected to grow by 25%, influencing the adoption of grid computing technologies that prioritize data protection. This trend suggests that as businesses seek to safeguard their operations, the grid computing market will play a crucial role in providing secure and resilient computing environments.

Rising Demand for Data Processing

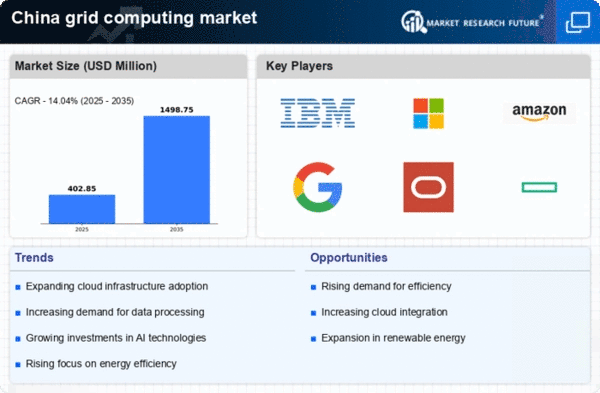

The grid computing market in China is experiencing a notable surge in demand for data processing capabilities. As organizations increasingly rely on data-driven decision-making, the need for efficient data management solutions becomes paramount. In 2025, the market is projected to grow at a CAGR of approximately 15%, driven by sectors such as finance, healthcare, and telecommunications. These industries require robust computing power to analyze vast datasets, leading to a greater reliance on grid computing technologies. The grid computing market is thus positioned to benefit from this trend, as it offers scalable solutions that can handle complex computations and large volumes of data, ultimately enhancing operational efficiency.

Government Initiatives and Support

The Chinese government is actively promoting the development of the grid computing market through various initiatives and policies. Investments in digital infrastructure and technology innovation are part of the national strategy to enhance the country's technological capabilities. In 2025, government funding for research and development in grid computing is expected to exceed $500 million, fostering innovation and collaboration among public and private sectors. This support is likely to accelerate the adoption of grid computing solutions across multiple industries, positioning the grid computing market as a critical component of China's digital economy.

Growing Need for Collaborative Computing

As businesses in China increasingly adopt collaborative work environments, the demand for grid computing solutions is on the rise. The grid computing market facilitates seamless collaboration by enabling multiple users to access shared resources and applications in real-time. This trend is particularly evident in sectors such as education and research, where collaborative projects require significant computational resources. By 2025, it is anticipated that the market for collaborative computing solutions will grow by over 20%, highlighting the importance of grid computing technologies in supporting teamwork and innovation across various fields.