Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) are emerging as a crucial driver for the smart infrastructure market in China. These collaborations between government entities and private companies facilitate the financing and implementation of large-scale infrastructure projects. By leveraging private sector expertise and capital, PPPs enable the development of innovative smart infrastructure solutions. The Chinese government has been actively promoting PPP models, particularly in sectors such as transportation and energy. This approach not only accelerates project delivery but also enhances the quality of infrastructure services. The market for PPPs in smart infrastructure is expected to expand, with investments projected to exceed $100 billion by 2025. This trend indicates a growing recognition of the value of collaborative efforts in addressing infrastructure challenges.

Urbanization and Population Growth

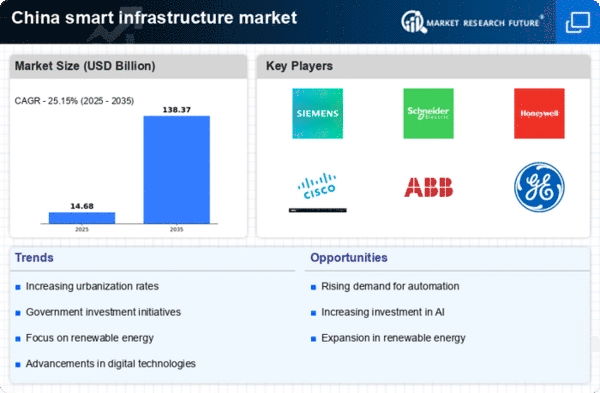

The rapid urbanization in China is a primary driver for the smart infrastructure market. As urban populations continue to swell, the demand for efficient infrastructure solutions intensifies. By 2025, it is projected that over 60% of China's population will reside in urban areas, necessitating advanced infrastructure to support this growth. Smart infrastructure technologies, such as intelligent transportation systems and energy-efficient buildings, are increasingly being adopted to manage urban challenges. The market is expected to reach approximately $200 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 15%. This growth underscores the critical need for innovative solutions to accommodate the burgeoning urban populace, thereby propelling the smart infrastructure market forward.

Rising Demand for Smart Mobility Solutions

The increasing demand for smart mobility solutions is a significant driver of the smart infrastructure market in China. As urban congestion becomes a pressing issue, there is a growing need for intelligent transportation systems that enhance mobility and reduce travel times. Technologies such as autonomous vehicles, smart traffic management, and integrated public transport systems are gaining traction. The market for smart mobility solutions is projected to grow at a CAGR of 18%, reaching approximately $80 billion by 2025. This growth is fueled by government initiatives aimed at promoting sustainable transportation and reducing reliance on fossil fuels. The emphasis on smart mobility reflects a broader trend towards creating more livable urban environments, thereby propelling the smart infrastructure market.

Technological Advancements in Construction

Technological innovations in construction are significantly influencing the smart infrastructure market in China. The integration of advanced materials, automation, and digital tools enhances the efficiency and sustainability of infrastructure projects. For instance, the use of Building Information Modeling (BIM) and prefabrication techniques has streamlined construction processes, reducing costs and timeframes. The market for smart construction technologies is anticipated to grow by 20% annually, driven by the increasing adoption of these innovations. Furthermore, the Chinese government is actively promoting the use of smart technologies in construction, which is likely to further stimulate market growth. This trend indicates a shift towards more intelligent and responsive infrastructure solutions, aligning with the broader goals of urban development.

Environmental Regulations and Sustainability Goals

China's stringent environmental regulations and sustainability goals are pivotal in shaping the smart infrastructure market. The government has set ambitious targets to reduce carbon emissions and enhance energy efficiency, which necessitates the adoption of smart technologies. For example, the 14th Five-Year Plan emphasizes the importance of green infrastructure, aiming for a 20% reduction in energy consumption per unit of GDP by 2025. This regulatory framework encourages investments in smart infrastructure solutions that promote sustainability, such as smart grids and renewable energy systems. As a result, the market is projected to grow significantly, with estimates suggesting a value of $150 billion by 2025. This growth reflects the increasing alignment of infrastructure development with environmental stewardship.