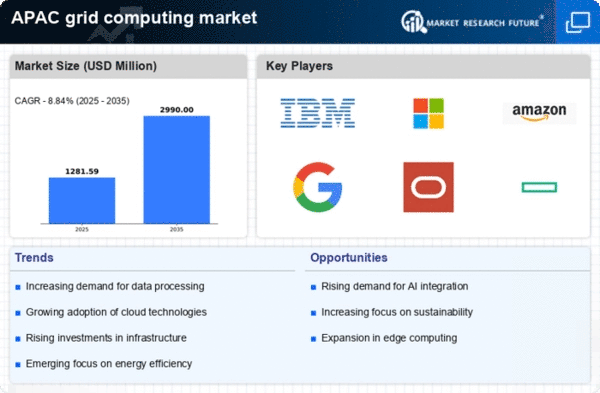

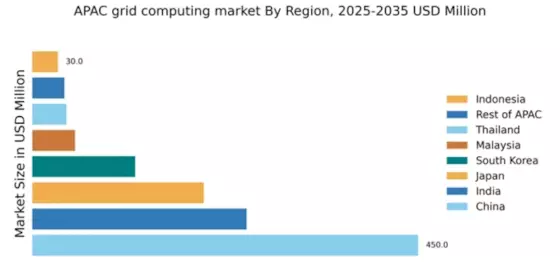

China : Unmatched Growth and Innovation

Key markets include major cities like Beijing, Shanghai, and Shenzhen, which are hubs for technology and innovation. The competitive landscape features significant players such as Alibaba Cloud, Huawei, and Tencent, alongside global giants like IBM and Microsoft. The local business environment is characterized by a strong emphasis on R&D and collaboration between public and private sectors, particularly in AI and IoT applications.

India : Emerging Market with High Potential

Key markets include Bengaluru, Hyderabad, and Pune, known for their tech ecosystems. The competitive landscape features major players like Tata Consultancy Services, Wipro, and global firms such as Amazon and Microsoft. The local market dynamics are characterized by a vibrant startup culture and a growing focus on sectors like e-commerce, fintech, and healthcare, which are increasingly leveraging grid computing solutions.

Japan : Strong Focus on R&D and AI

Key markets include Tokyo, Osaka, and Nagoya, which are centers for technology and innovation. The competitive landscape features major players like Fujitsu and NEC, alongside global firms such as IBM and Google. The local business environment is characterized by a strong focus on collaboration between academia and industry, particularly in sectors like automotive and healthcare, which are increasingly adopting grid computing technologies.

South Korea : Strong Government Support and Innovation

Key markets include Seoul and Busan, which are hubs for technology and innovation. The competitive landscape features major players like Samsung and LG, alongside global firms such as Microsoft and Amazon. The local market dynamics are characterized by a strong emphasis on R&D and collaboration between public and private sectors, particularly in sectors like gaming and fintech, which are increasingly leveraging grid computing solutions.

Malaysia : Focus on Digital Transformation

Key markets include Kuala Lumpur and Penang, known for their tech ecosystems. The competitive landscape features local players like Telekom Malaysia and global firms such as IBM and Microsoft. The local business environment is characterized by a growing focus on sectors like e-commerce and fintech, which are increasingly adopting grid computing technologies to enhance operational efficiency.

Thailand : Focus on Cloud and Digital Services

Key markets include Bangkok and Chiang Mai, which are emerging tech hubs. The competitive landscape features local players like Advanced Info Service and global firms such as Amazon and Microsoft. The local market dynamics are characterized by a growing focus on sectors like e-commerce and tourism, which are increasingly leveraging grid computing solutions to enhance operational efficiency and customer experience.

Indonesia : Focus on Digital Economy Initiatives

Key markets include Jakarta and Surabaya, which are emerging tech hubs. The competitive landscape features local players like Telkom Indonesia and global firms such as Amazon and Microsoft. The local market dynamics are characterized by a growing focus on sectors like e-commerce and fintech, which are increasingly leveraging grid computing solutions to enhance operational efficiency and customer experience.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include emerging tech hubs in countries like Vietnam and the Philippines. The competitive landscape features a mix of local players and global firms like IBM and Microsoft. The local market dynamics are characterized by varied growth rates and challenges, with sectors like e-commerce and telecommunications increasingly adopting grid computing solutions to enhance operational efficiency.