Emergence of Smart Technologies

The emergence of smart technologies is significantly influencing the in memory-computing market in China. With the rise of the Internet of Things (IoT) and artificial intelligence (AI), there is an increasing demand for solutions that can process data rapidly and efficiently. In memory-computing provides the necessary speed and agility to handle the vast amounts of data generated by smart devices. The market is projected to grow as industries such as manufacturing, healthcare, and transportation adopt these technologies. The in memory-computing market is poised to benefit from this trend, as organizations seek to harness the power of smart technologies to optimize operations and improve decision-making processes. This shift towards smart solutions is likely to drive further innovation in the in memory-computing space.

Growing Adoption of Big Data Technologies

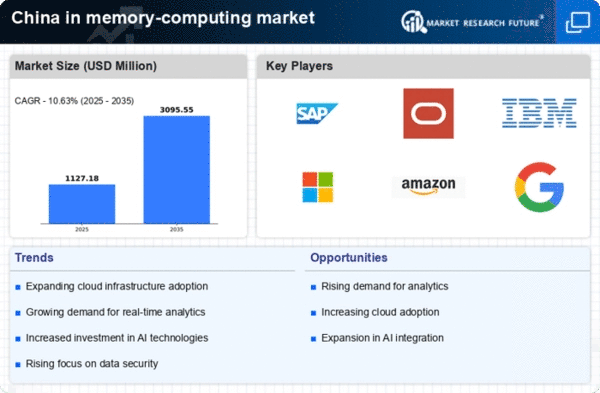

The in memory-computing market in China is experiencing a surge due to the growing adoption of big data technologies. Organizations are increasingly leveraging big data analytics to gain insights and drive decision-making processes. This trend is reflected in the market, where the demand for in memory-computing solutions is projected to grow at a CAGR of approximately 25% from 2025 to 2030. Companies are recognizing the need for faster data processing capabilities, which in memory-computing provides. As businesses accumulate vast amounts of data, the ability to analyze this information in real-time becomes crucial. The in memory-computing market is thus positioned to benefit significantly from this trend, as enterprises seek to enhance their operational efficiency and competitive advantage through advanced analytics.

Increased Investment in IT Infrastructure

Investment in IT infrastructure is a key driver for the in memory-computing market in China. As organizations strive to modernize their IT environments, they are allocating substantial budgets towards upgrading their hardware and software systems. In 2025, IT spending in China is expected to reach approximately $200 billion, with a significant portion directed towards technologies that support in memory-computing. This investment is essential for enabling faster data processing and analytics capabilities. The in memory-computing market stands to gain from this trend, as businesses require robust solutions that can handle large volumes of data efficiently. Enhanced IT infrastructure not only supports in memory-computing applications but also fosters innovation and digital transformation across various sectors.

Rising Need for Enhanced Customer Experience

The in memory-computing market in China is driven by the rising need for enhanced customer experience. Companies are increasingly focusing on delivering personalized services and products to their customers. In memory-computing solutions enable organizations to analyze customer data in real-time, allowing for tailored marketing strategies and improved service delivery. This trend is particularly evident in the retail and e-commerce sectors, where businesses are investing heavily in technologies that facilitate real-time data analysis. The in memory-computing market is likely to see substantial growth as companies prioritize customer-centric approaches. By leveraging in memory-computing, organizations can respond swiftly to customer needs, thereby enhancing satisfaction and loyalty.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at supporting digital transformation are playing a crucial role in the growth of the in memory-computing market in China. The Chinese government has launched various programs to promote the adoption of advanced technologies across industries. These initiatives often include funding, incentives, and regulatory support for businesses investing in digital solutions. As a result, organizations are increasingly turning to in memory-computing to enhance their data processing capabilities. The in memory-computing market is expected to thrive as these government policies encourage innovation and the integration of cutting-edge technologies. This supportive environment is likely to accelerate the adoption of in memory-computing solutions, driving market growth in the coming years.