Rising E-commerce Sector

The e-commerce sector in China has witnessed exponential growth, with online retail sales expected to surpass $2 trillion by 2025. This surge in e-commerce activities necessitates the development of user-friendly and visually appealing interfaces to enhance customer experience. As businesses strive to differentiate themselves in a competitive market, the demand for high-quality graphical user-interface-design software is likely to increase. Companies are investing in sophisticated design tools to create engaging online shopping experiences, thereby driving the graphical user-interface-design-software market. The integration of features such as personalized recommendations and seamless navigation further emphasizes the need for effective design solutions in the e-commerce landscape.

Growing Emphasis on User Experience (UX)

In the competitive landscape of software development, there is a growing emphasis on user experience (UX) in China. Companies are increasingly recognizing that a well-designed interface can significantly impact user satisfaction and retention. This shift in focus is driving demand for graphical user-interface-design software that prioritizes UX principles. As businesses strive to create products that resonate with users, they are likely to invest in tools that facilitate the design of intuitive and engaging interfaces. The graphical user-interface-design-software market is expected to benefit from this trend, as organizations seek to leverage design as a strategic advantage in attracting and retaining customers.

Emergence of Startups and Innovation Hubs

China's vibrant startup ecosystem and the establishment of innovation hubs are contributing to the growth of the graphical user-interface-design-software market. Startups are increasingly focusing on developing unique applications and platforms that require cutting-edge design capabilities. The influx of venture capital into technology-driven startups fosters an environment ripe for innovation, leading to the creation of novel graphical user-interface-design solutions. As these startups seek to capture market share, they are likely to invest in advanced design software to enhance their product offerings. This trend indicates a dynamic shift in the graphical user-interface-design-software market, where creativity and innovation play pivotal roles in shaping the future of digital experiences.

Increasing Demand for Mobile Applications

The rapid proliferation of mobile devices in China has led to a heightened demand for mobile applications, which in turn drives the graphical user-interface-design-software market. As of 2025, mobile app usage in China is projected to reach over 1 billion users, necessitating intuitive and visually appealing interfaces. This trend compels software developers to invest in advanced design tools that facilitate the creation of user-friendly mobile applications. Consequently, the graphical user-interface-design-software market is likely to experience substantial growth as developers seek to enhance user engagement and satisfaction through innovative design solutions. The emphasis on mobile-first design strategies further underscores the importance of effective graphical user-interface-design software in meeting consumer expectations.

Government Initiatives Supporting Digital Transformation

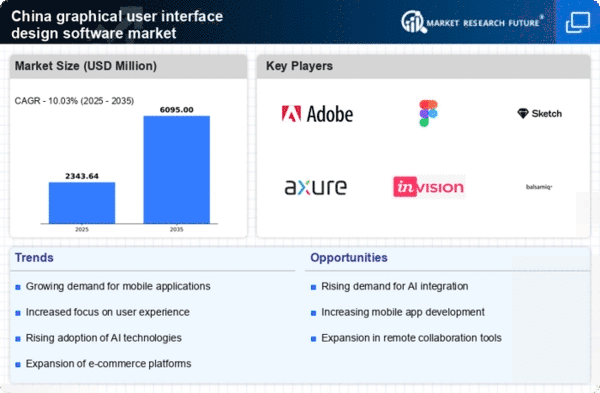

The Chinese government has been actively promoting digital transformation across various sectors, which significantly impacts the graphical user-interface-design-software market. Initiatives such as the 'Digital China' strategy aim to enhance the country's digital infrastructure and encourage the adoption of advanced technologies. As a result, businesses are increasingly investing in software solutions that improve their digital presence, including graphical user-interface-design software. This government support is expected to boost market growth, with projections indicating a compound annual growth rate (CAGR) of approximately 15% in the coming years. The alignment of government policies with industry needs creates a conducive environment for the graphical user-interface-design-software market to thrive.