Rising Demand for STEM Education

The government education market in Japan is experiencing a notable shift towards Science, Technology, Engineering, and Mathematics (STEM) education. This trend is driven by the increasing recognition of the importance of these fields in fostering innovation and economic growth. In recent years, the Japanese government has allocated approximately 10 billion JPY to enhance STEM programs in public schools. This investment aims to equip students with essential skills for the future workforce, thereby addressing the skills gap in the technology sector. As a result, educational institutions are adapting their curricula to emphasize STEM subjects, which is likely to attract more students and improve overall educational outcomes in the government education market.

Emphasis on Environmental Education

In response to global environmental challenges, the government education market in Japan is placing a heightened emphasis on environmental education. The government has introduced initiatives aimed at integrating sustainability concepts into school curricula, reflecting a commitment to fostering eco-conscious citizens. Recent data indicates that approximately 70% of public schools have adopted environmental education programs. This focus not only aims to raise awareness among students but also encourages active participation in sustainability efforts. As a result, the government education market is evolving to include environmental literacy as a core component of education, potentially shaping future generations' attitudes towards ecological responsibility.

Focus on Mental Health and Well-being

The government education market in Japan is increasingly prioritizing mental health and well-being within educational settings. Recognizing the impact of mental health on academic performance, the government has implemented programs aimed at promoting psychological support in schools. Recent surveys indicate that nearly 60% of students report experiencing stress related to academic pressures. In response, the government has allocated funding to train educators in mental health awareness and support strategies. This focus on well-being is likely to create a more supportive learning environment, ultimately enhancing student outcomes in the government education market.

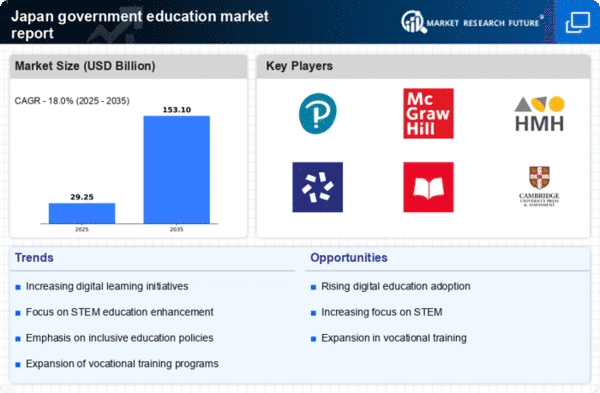

Expansion of Vocational Training Programs

The government education market in Japan is witnessing a significant expansion of vocational training programs. This shift is largely driven by the need to align educational outcomes with labor market demands. The Japanese government has recognized the importance of equipping students with practical skills, leading to an investment of approximately 15 billion JPY in vocational education initiatives. These programs are designed to provide students with hands-on experience and industry-relevant skills, thereby enhancing employability. As a result, the government education market is likely to see an increase in student enrollment in vocational courses, addressing the skills mismatch in various sectors.

Integration of Artificial Intelligence in Education

The integration of Artificial Intelligence (AI) technologies into the government education market is transforming traditional teaching methodologies. AI applications are being utilized to personalize learning experiences, assess student performance, and streamline administrative tasks. The Japanese government has initiated several pilot programs, investing around 5 billion JPY to explore AI's potential in enhancing educational efficiency. This technological advancement appears to facilitate tailored educational approaches, catering to diverse learning needs. Consequently, the government education market is likely to see improved student engagement and academic performance, as AI tools become increasingly prevalent in classrooms across Japan.