Advancements in AI Technology

Technological advancements in AI are significantly influencing the generative ai-in-media-and-entertainment market in China. Innovations in machine learning algorithms and natural language processing are enabling more sophisticated content generation capabilities. For instance, AI-driven tools can now produce high-quality scripts, music, and visual art, which were previously the domain of human creators. This evolution is likely to reduce production costs and time, making it more feasible for smaller studios to compete. The market is projected to grow at a CAGR of 25% over the next five years, driven by these technological improvements. As AI continues to evolve, its integration into various media forms is expected to become more seamless, further enhancing the creative process.

Emergence of New Business Models

The generative AI in media and entertainment market in China is witnessing the emergence of innovative business models driven by AI capabilities. Companies are exploring subscription-based services, pay-per-use models, and ad-supported content that leverage AI-generated material. This shift allows for more flexible monetization strategies, catering to diverse consumer preferences. As AI-generated content becomes more prevalent, businesses are likely to capitalize on its scalability and cost-effectiveness. The market could see a transformation in revenue generation, with projections indicating that AI-driven business models may account for up to 40% of total media revenues by 2030. This evolution reflects a broader trend towards digital transformation in the media sector.

Government Support and Regulation

The generative AI in media and entertainment market in China is benefiting from increased government support and regulatory frameworks aimed at fostering innovation. The Chinese government has recognized the potential of AI technologies in enhancing the media landscape and is actively promoting research and development initiatives. This support includes funding for AI startups and incentives for established companies to adopt AI solutions. Furthermore, regulatory measures are being established to ensure ethical AI usage, which could enhance public trust in AI-generated content. As a result, the market is likely to see accelerated growth, with projections indicating a potential increase in market size by 30% over the next few years due to favorable policies.

Integration of AI in Traditional Media

The integration of AI technologies into traditional media formats is reshaping the generative ai-in-media-and-entertainment market in China. Traditional media outlets are increasingly adopting AI tools for content creation, distribution, and audience engagement. For example, news organizations are utilizing AI to automate reporting and generate real-time updates, thereby enhancing operational efficiency. This trend is expected to lead to a more dynamic media landscape, where AI-generated content complements human creativity. The market is anticipated to expand as traditional media companies recognize the value of AI in improving their offerings, with estimates suggesting a growth rate of 20% in the next few years as they adapt to these technological changes.

Rising Demand for Personalized Content

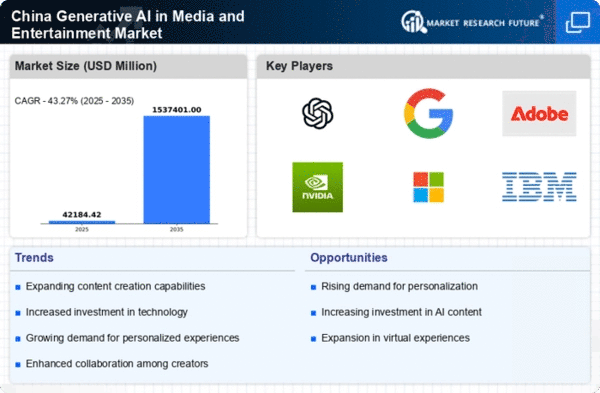

The generative AI in media and entertainment market in China is experiencing a notable surge in demand for personalized content. As consumers increasingly seek tailored experiences, media companies are leveraging generative AI to create customized narratives and interactive experiences. This trend is reflected in the growing investment in AI technologies, with estimates suggesting that the market could reach a valuation of $10 billion by 2026. The ability to analyze user preferences and generate content that resonates with individual tastes is becoming a key differentiator for companies. This shift not only enhances user engagement but also drives revenue growth, as personalized content is often associated with higher conversion rates and customer loyalty.