Rising E-Sports Popularity

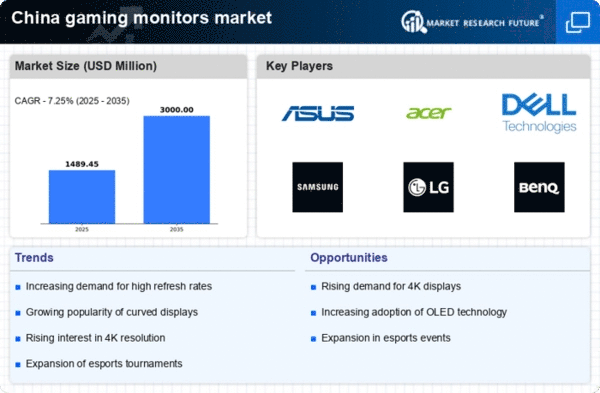

The gaming monitors market in China experiences a notable boost due to the surging popularity of e-sports. With millions of players and viewers, e-sports events attract significant attention, leading to increased demand for high-performance gaming monitors. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for monitors that can deliver superior refresh rates and response times. As competitive gaming becomes more mainstream, consumers are increasingly seeking monitors that enhance their gaming experience, thus propelling the gaming monitors market forward. Furthermore, the rise of professional gaming leagues and tournaments in China has created a culture where high-quality gaming equipment is essential, further solidifying the importance of advanced gaming monitors in this thriving industry.

Influence of Online Gaming Communities

The gaming monitors market in China is significantly impacted by the vibrant online gaming communities that foster engagement and interaction among players. These communities often share recommendations and reviews, influencing purchasing decisions. As gamers seek to enhance their performance and experience, they are likely to invest in high-quality monitors that are endorsed by their peers. This social aspect of gaming can drive demand for specific brands and models, creating a competitive landscape within the gaming monitors market. Additionally, the rise of streaming platforms has further amplified this trend, as gamers showcase their setups, including monitors, to their audiences. This visibility may encourage more consumers to prioritize quality in their gaming equipment, thereby propelling the gaming monitors market.

Increased Disposable Income Among Consumers

The gaming monitors market in China is positively influenced by the rising disposable income of consumers. As the middle class expands, more individuals are willing to invest in high-quality gaming equipment. This trend is particularly evident among younger demographics, who prioritize gaming as a primary form of entertainment. Reports indicate that consumer spending on electronics, including gaming monitors, has increased by approximately 20% in recent years. This financial capability allows gamers to opt for advanced features such as higher refresh rates and larger screen sizes, which are essential for an immersive gaming experience. Consequently, the gaming monitors market is likely to see sustained growth as more consumers seek to enhance their gaming setups with premium monitors.

Growing Demand for Multi-Functional Monitors

The gaming monitors market in China is witnessing a shift towards multi-functional monitors that cater to both gaming and professional use. As remote work and online learning become more prevalent, consumers are increasingly looking for monitors that can serve dual purposes. This trend suggests a potential increase in demand for monitors with features such as adjustable stands, built-in speakers, and multiple connectivity options. The market is likely to respond to this demand by offering versatile products that appeal to a broader audience. As of November 2025, it appears that the gaming monitors market is adapting to these changing consumer preferences, which may lead to a diversification of product offerings to meet the needs of both gamers and professionals.

Technological Advancements in Display Technology

Technological innovations play a crucial role in shaping the gaming monitors market in China. The introduction of OLED and Mini-LED technologies has revolutionized display quality, offering gamers enhanced color accuracy and contrast ratios. These advancements are likely to attract consumers who prioritize visual performance in their gaming setups. As of November 2025, the market sees a growing trend towards monitors with 4K resolution and high dynamic range (HDR) capabilities, which are becoming increasingly accessible. This shift indicates a potential increase in consumer spending on premium gaming monitors, as players seek to elevate their gaming experiences. The gaming monitors market is expected to benefit from these technological improvements, as manufacturers continue to innovate and meet the evolving demands of gamers.