Advancements in Technology

Technological advancements are playing a pivotal role in shaping the China functional service providers market. The integration of artificial intelligence, big data analytics, and cloud computing is transforming how services are delivered. For instance, the use of AI in data analysis has streamlined processes, allowing for faster decision-making and improved accuracy in clinical trials. In 2025, it was estimated that over 60% of functional service providers in China had adopted advanced technologies to enhance their service offerings. This trend not only increases operational efficiency but also attracts more clients seeking innovative solutions. As technology continues to evolve, it is likely that the functional service providers will further enhance their capabilities, thereby expanding their market presence in China.

Expansion of Global Partnerships

The China functional service providers market is witnessing an expansion of global partnerships, which is enhancing its competitive landscape. As companies seek to enter international markets, they are increasingly collaborating with functional service providers that possess local expertise. In 2025, it was reported that over 40% of functional service providers in China had established partnerships with foreign firms to leverage their global networks. These collaborations facilitate knowledge transfer and access to advanced technologies, thereby improving service delivery. Furthermore, such partnerships enable Chinese companies to comply with international standards, making them more attractive to global clients. The trend of forming strategic alliances is expected to continue, further solidifying the position of the China functional service providers market on the global stage.

Regulatory Support and Compliance

The regulatory landscape in China is evolving, providing a supportive environment for the functional service providers market. The government has implemented various policies aimed at streamlining regulatory processes, particularly in the pharmaceutical and biotechnology sectors. In 2025, the National Medical Products Administration (NMPA) introduced new guidelines that simplified the approval process for clinical trials, which is expected to boost the demand for functional service providers. This regulatory support not only facilitates faster market entry for new drugs but also encourages foreign investment in the sector. As compliance becomes increasingly complex, companies are likely to rely more on functional service providers to navigate these regulations, thereby driving growth in the market.

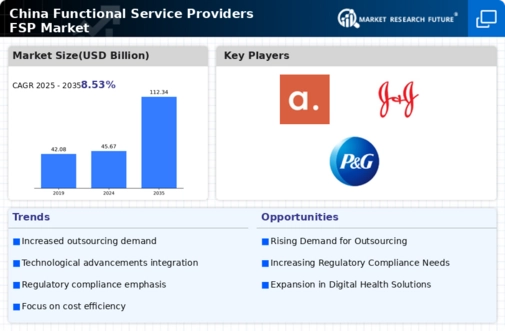

Growing Demand for Outsourced Services

The China functional service providers market is experiencing a notable increase in demand for outsourced services. This trend is driven by companies seeking to enhance operational efficiency and reduce costs. In 2025, the outsourcing market in China was valued at approximately 50 billion USD, reflecting a compound annual growth rate of around 10%. As businesses focus on core competencies, they are increasingly turning to functional service providers for specialized services such as clinical trials, data management, and regulatory affairs. This shift not only allows companies to allocate resources more effectively but also enables them to leverage the expertise of service providers, thereby improving overall service quality. The growing demand for these services is expected to continue, further propelling the growth of the China functional service providers market.

Increased Focus on Quality and Compliance

Quality assurance and compliance are becoming paramount in the China functional service providers market. As the market matures, clients are placing greater emphasis on the quality of services provided. In 2025, approximately 70% of companies reported that they prioritize working with service providers that adhere to stringent quality standards. This trend is particularly evident in sectors such as pharmaceuticals and clinical research, where regulatory scrutiny is high. Functional service providers that demonstrate a commitment to quality and compliance are likely to gain a competitive edge. This focus on quality not only enhances client trust but also contributes to the overall reputation of the industry, fostering further growth and investment in the China functional service providers market.