Regulatory Compliance Pressure

The freight management-system market in China is experiencing heightened pressure due to stringent regulatory compliance requirements. The government has implemented various policies aimed at enhancing logistics efficiency and safety standards. This regulatory landscape necessitates that companies invest in advanced freight management systems to ensure adherence to these regulations. As a result, the demand for sophisticated software solutions that can facilitate compliance tracking and reporting is likely to increase. Furthermore, the market is projected to grow as businesses seek to avoid penalties associated with non-compliance, which can be substantial. In 2025, the estimated value of the freight management-system market in China is expected to reach approximately $3 billion, driven by the need for compliance with evolving regulations.

Focus on Cost Reduction Strategies

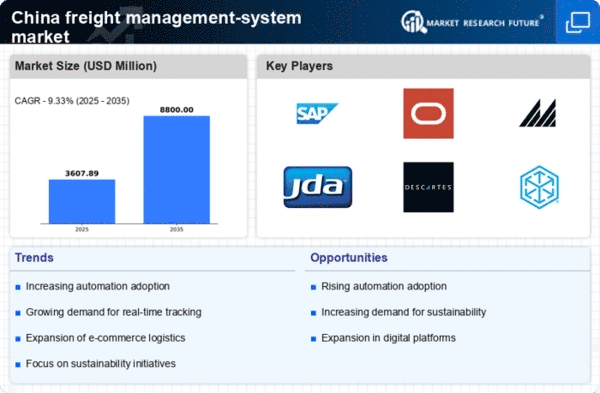

In the freight management-system market, the emphasis on cost reduction strategies is becoming increasingly pronounced among businesses in China. Companies are actively seeking ways to minimize logistics expenses while maintaining service quality. This focus on cost efficiency is driving the adoption of advanced freight management systems that offer features such as route optimization, load planning, and inventory management. By leveraging these technologies, organizations can achieve significant savings in transportation and operational costs. It is projected that the freight management-system market will experience a compound annual growth rate (CAGR) of around 12% through 2025, as businesses prioritize cost-effective solutions to enhance their competitive positioning.

Growing E-commerce Logistics Requirements

The freight management-system market is significantly influenced by the burgeoning e-commerce sector in China. As online shopping continues to gain traction, the demand for efficient logistics solutions is escalating. E-commerce companies require advanced freight management systems to handle increased order volumes, optimize delivery routes, and ensure timely shipments. This trend is likely to drive innovation within the freight management-system market, as providers develop tailored solutions to meet the unique challenges posed by e-commerce logistics. By 2025, it is anticipated that the freight management-system market could see a growth rate of approximately 15%, largely fueled by the evolving needs of the e-commerce industry.

Rising Demand for Supply Chain Visibility

In the context of the freight management-system market, the demand for enhanced supply chain visibility is becoming increasingly critical. Companies are recognizing the importance of real-time tracking and monitoring of shipments to improve operational efficiency and customer satisfaction. This trend is particularly pronounced in China, where the logistics sector is rapidly evolving. The integration of advanced technologies such as IoT and AI into freight management systems is facilitating greater transparency and control over supply chains. As businesses strive to optimize their logistics operations, the freight management-system market is likely to witness significant growth. It is estimated that by 2025, the market could expand by over 20%, reflecting the urgent need for improved visibility in supply chain processes.

Increased Investment in Digital Transformation

The freight management-system market is witnessing a surge in investment as companies in China prioritize digital transformation initiatives. Organizations are increasingly adopting cloud-based solutions and automation technologies to streamline their logistics operations. This shift is driven by the need to enhance efficiency, reduce operational costs, and improve service delivery. As businesses recognize the competitive advantages offered by digital freight management systems, the market is expected to grow substantially. Reports indicate that the digital logistics market in China could reach $10 billion by 2025, with a significant portion attributed to advancements in freight management systems. This trend suggests a robust future for the freight management-system market as companies embrace innovative technologies.