Growth of IoT Applications

The proliferation of Internet of Things (IoT) applications is a critical driver for the fog computing market in China. With millions of devices being connected, the need for efficient data management and processing becomes paramount. Fog computing offers a solution by enabling data to be processed closer to the source, thus alleviating the burden on centralized cloud systems. Industries such as agriculture, healthcare, and smart cities are increasingly adopting IoT solutions that leverage fog computing to enhance operational capabilities. It is estimated that the number of IoT devices in China will reach over 1 billion by 2026, further propelling the demand for fog computing technologies.

Enhanced Data Privacy Regulations

The fog computing market in China is also shaped by the evolving landscape of data privacy regulations. As concerns regarding data security and user privacy intensify, businesses are compelled to adopt solutions that ensure compliance with stringent regulations. Fog computing provides a framework that allows for localized data processing, which can enhance data security by minimizing the risk of data breaches associated with centralized cloud storage. The implementation of laws such as the Personal Information Protection Law (PIPL) necessitates that companies adopt more robust data management practices. Consequently, this regulatory environment is likely to drive the adoption of fog computing solutions, as organizations seek to align with compliance requirements.

Government Initiatives and Support

Various government initiatives aimed at promoting technological advancements significantly influence the fog computing market in China.. The Chinese government has been actively investing in smart infrastructure and digital transformation projects, which inherently rely on fog computing technologies. For instance, the implementation of the 'Made in China 2025' strategy emphasizes the importance of integrating advanced technologies into manufacturing processes. This governmental backing not only provides financial incentives but also fosters an environment conducive to innovation. As a result, the fog computing market is likely to benefit from increased funding and support, potentially leading to a market valuation exceeding $10 billion by 2027.

Rising Demand for Edge Computing Solutions

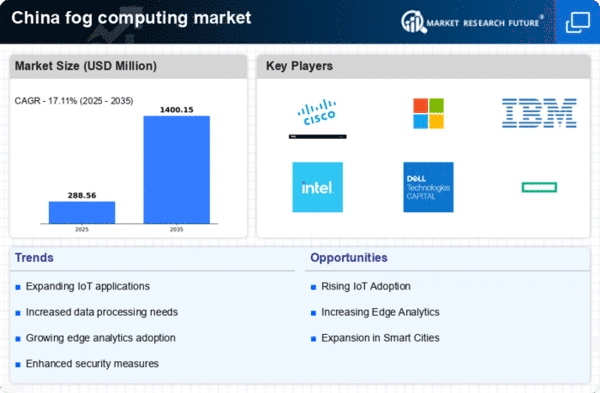

The fog computing market in China is seeing a significant increase in demand for edge computing solutions.. This trend is driven by the increasing need for real-time data processing and analytics, particularly in sectors such as manufacturing and transportation. As industries seek to enhance operational efficiency, the integration of fog computing technologies allows for localized data processing, reducing latency and bandwidth usage. According to recent estimates, the market for edge computing solutions is projected to grow at a CAGR of approximately 30% over the next five years. This growth is indicative of the broader shift towards decentralized computing architectures, which are essential for supporting the fog computing market in China.

Increased Investment in Smart Infrastructure

Increased investment in smart infrastructure projects positions the fog computing market in China for growth.. Urbanization and the need for efficient resource management are driving cities to adopt smart technologies that rely on fog computing. Investments in smart grids, intelligent transportation systems, and connected public services are becoming more prevalent. These projects require real-time data processing capabilities, which fog computing can provide. It is projected that investments in smart infrastructure will exceed $200 billion by 2025, creating a favorable environment for the fog computing market to flourish. This trend indicates a long-term commitment to integrating advanced technologies into urban planning and development.