Government Initiatives and Funding

Government initiatives aimed at enhancing fire safety standards play a crucial role in shaping the fire protection-systems market. In recent years, the Chinese government has implemented various policies and funding programs to promote fire safety in both residential and commercial sectors. These initiatives include subsidies for fire safety equipment and incentives for compliance with safety regulations. As a result, the market is likely to experience increased investments, with projections indicating a potential growth of 10% in funding for fire safety projects by 2026. Such government support is essential for fostering innovation and ensuring widespread adoption of fire protection systems.

Increased Awareness of Fire Safety

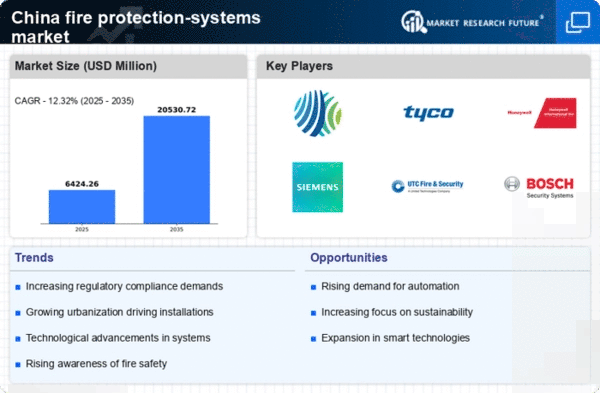

There is a notable increase in public awareness regarding fire safety in China, which significantly influences the fire protection-systems market. Educational campaigns and media coverage have heightened the understanding of fire risks among businesses and homeowners. This awareness has led to a surge in demand for fire detection and suppression systems. Recent statistics suggest that the market for fire safety equipment in China is expected to grow at a CAGR of approximately 8% over the next five years. This growth reflects a shift in consumer behavior, where individuals and organizations prioritize safety measures, thereby driving the fire protection-systems market.

Technological Integration in Fire Safety

The integration of advanced technologies into fire protection systems is transforming the landscape of the fire protection-systems market. Innovations such as IoT-enabled devices, smart alarms, and automated suppression systems are becoming increasingly prevalent. These technologies enhance the efficiency and effectiveness of fire safety measures, allowing for real-time monitoring and rapid response to fire incidents. The market for smart fire protection solutions in China is anticipated to witness substantial growth, with estimates suggesting a potential increase of 15% in adoption rates by 2027. This technological evolution not only improves safety outcomes but also aligns with the growing demand for intelligent building solutions.

Rising Industrialization and Manufacturing

The ongoing industrialization in China is a significant driver for the fire protection-systems market. As manufacturing activities expand, the need for comprehensive fire safety measures becomes paramount. Industries such as chemicals, textiles, and electronics are particularly vulnerable to fire hazards, necessitating the implementation of stringent fire protection protocols. Recent data indicates that the industrial sector contributes approximately 40% to China's GDP, underscoring the importance of fire safety in maintaining operational continuity. Consequently, investments in fire protection systems are expected to rise, with estimates suggesting a growth rate of 12% in the industrial segment of the market over the next few years.

Urbanization and Infrastructure Development

The rapid urbanization in China is a pivotal driver for the fire protection-systems market. As cities expand and new infrastructures emerge, the demand for advanced fire safety solutions increases. The construction of high-rise buildings, commercial complexes, and industrial facilities necessitates robust fire protection systems to mitigate risks. According to recent data, the urban population in China is projected to reach 1 billion by 2030, which could lead to a substantial rise in fire safety investments. This trend indicates a growing awareness of fire hazards and the need for compliance with safety regulations, thereby propelling the fire protection-systems market forward.