Growing Consumer Awareness

Growing consumer awareness regarding the benefits of biometric authentication is contributing to the expansion of the fingerprint biometrics market. As individuals become more informed about the advantages of using fingerprint recognition for secure access and transactions, the demand for such solutions is likely to increase. This trend is particularly evident among tech-savvy consumers who prioritize security in their digital interactions. The market is expected to see a rise in adoption rates as consumers seek reliable and efficient authentication methods. Additionally, educational campaigns and marketing efforts by biometric solution providers are likely to further enhance consumer understanding and acceptance of fingerprint biometrics, thereby driving market growth.

Technological Advancements

Technological advancements play a pivotal role in the expansion of the fingerprint biometrics market. Innovations in sensor technology, algorithms, and data processing capabilities are enhancing the accuracy and speed of fingerprint recognition systems. For instance, the introduction of capacitive and optical sensors has improved the reliability of biometric authentication. The market is expected to witness a surge in demand for these advanced systems, particularly in mobile devices and access control applications. As technology continues to evolve, the integration of artificial intelligence and machine learning into fingerprint recognition systems is anticipated to further enhance their effectiveness. This technological evolution is likely to attract investments and drive the growth of the fingerprint biometrics market in China.

Increasing Security Concerns

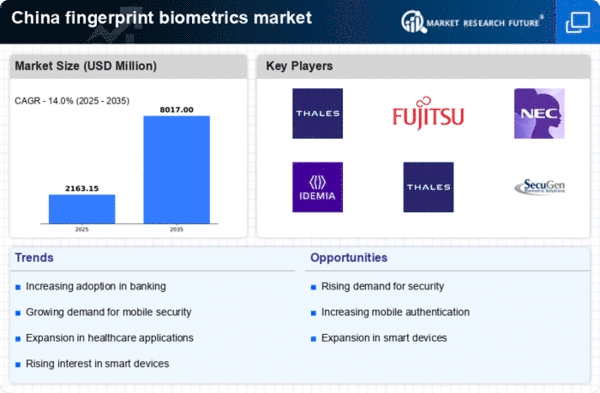

The fingerprint biometrics market is experiencing growth due to escalating security concerns across various sectors in China. With rising incidents of identity theft and cybercrime, organizations are increasingly adopting biometric solutions to enhance security measures. The market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, driven by the need for secure authentication methods. Businesses are investing in fingerprint biometrics to protect sensitive data and ensure secure access to facilities. This trend is particularly evident in sectors such as banking, healthcare, and government, where safeguarding personal information is paramount. As security threats evolve, the demand for advanced biometric systems is likely to increase, further propelling the fingerprint biometrics market in China.

Rising Adoption in E-commerce

The fingerprint biometrics market is benefiting from the rising adoption of biometric authentication in the e-commerce sector. As online shopping continues to gain traction in China, businesses are increasingly implementing fingerprint recognition systems to streamline the payment process and enhance user experience. This trend is particularly significant given that the e-commerce market in China is projected to reach approximately $2 trillion by 2025. By integrating fingerprint biometrics, companies can offer secure and convenient payment options, thereby reducing the risk of fraud. The growing consumer preference for seamless and secure transactions is likely to drive the demand for fingerprint biometrics solutions in the e-commerce landscape, further bolstering the market.

Government Regulations and Compliance

Government regulations and compliance requirements are significantly influencing the fingerprint biometrics market in China. Authorities are mandating stricter security protocols across various industries, particularly in finance and healthcare. These regulations often necessitate the implementation of biometric authentication systems to ensure compliance with data protection laws. As a result, organizations are increasingly investing in fingerprint biometrics to meet these regulatory demands. The market is expected to grow as businesses seek to align with government standards and enhance their security frameworks. This regulatory landscape is likely to create a conducive environment for the fingerprint biometrics market, driving innovation and adoption in the coming years.