Rising Incidence of Extremity Injuries

The increasing prevalence of extremity injuries in China is a primary driver for the extremity products market. Factors such as a growing aging population and a rise in sports-related activities contribute to this trend. According to recent health statistics, approximately 30% of the population aged over 60 experiences some form of extremity injury annually. This demographic shift necessitates advanced medical solutions, thereby propelling demand for extremity products. Furthermore, the healthcare system's focus on improving rehabilitation outcomes has led to increased investments in innovative extremity products. As a result, manufacturers are likely to see a surge in demand, which could lead to a market growth rate of around 8% over the next five years.

Government Initiatives and Healthcare Policies

Government initiatives aimed at enhancing healthcare infrastructure in China significantly impact the extremity products market. Policies promoting the adoption of advanced medical technologies and rehabilitation services are being implemented. For instance, the Chinese government has allocated substantial funding to improve healthcare facilities, which includes the procurement of extremity products. This funding is expected to increase by 15% in the next fiscal year, directly benefiting manufacturers and suppliers in the extremity products market. Additionally, the push for universal healthcare coverage encourages the integration of innovative extremity solutions, thereby expanding market access and driving growth.

Growing Awareness of Rehabilitation and Recovery

There is a notable increase in awareness regarding the importance of rehabilitation and recovery in China, which is driving the extremity products market. Patients and healthcare providers are increasingly recognizing the role of specialized products in enhancing recovery outcomes. This shift in perception is supported by educational campaigns and the availability of information on effective rehabilitation practices. Consequently, the demand for extremity products designed for rehabilitation purposes is expected to rise, with market analysts projecting a growth rate of approximately 7% annually. This trend indicates a promising future for manufacturers focusing on rehabilitation-oriented extremity solutions.

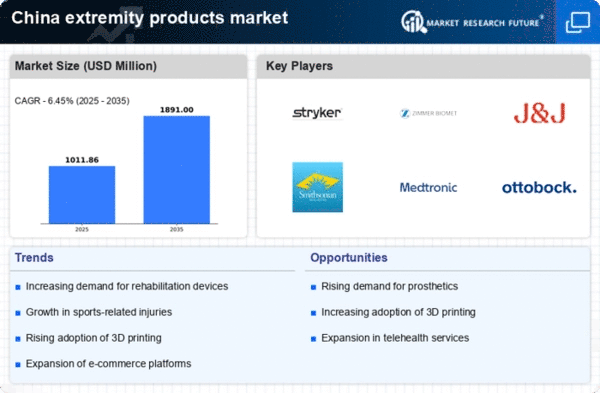

Expansion of E-commerce and Distribution Channels

The expansion of e-commerce platforms in China is transforming the distribution landscape for the extremity products market. With the rise of online shopping, consumers now have greater access to a variety of extremity products, which enhances market reach. E-commerce sales in the healthcare sector have surged, with estimates suggesting a growth of 20% in online sales of medical devices over the past year. This shift not only benefits consumers through increased convenience but also allows manufacturers to tap into new customer segments. As online retail continues to grow, it is likely to play a pivotal role in shaping the future dynamics of the extremity products market.

Technological Advancements in Product Development

Technological advancements play a crucial role in shaping the extremity products market. Innovations in materials and manufacturing processes have led to the development of lighter, more durable, and customizable products. For example, the introduction of 3D printing technology allows for the creation of tailored extremity solutions that meet individual patient needs. This trend is particularly relevant in China, where the demand for personalized medical devices is on the rise. As a result, companies that invest in research and development are likely to gain a competitive edge, potentially increasing their market share by up to 10% over the next few years.