Rising Incidence of ENT Disorders

The increasing prevalence of ear, nose, and throat (ENT) disorders in China is a primary driver for the ent treatment market. Reports indicate that conditions such as chronic sinusitis, otitis media, and allergic rhinitis are becoming more common, affecting a significant portion of the population. For instance, studies suggest that approximately 30% of adults in urban areas experience some form of ENT disorder annually. This rising incidence necessitates enhanced treatment options and healthcare services, thereby propelling the growth of the ent treatment market. Furthermore, the aging population in China, which is projected to reach 400 million by 2040, is likely to contribute to a higher demand for ENT treatments, as older individuals are more susceptible to these conditions. Consequently, the ent treatment market is expected to expand in response to these demographic shifts.

Advancements in Medical Technology

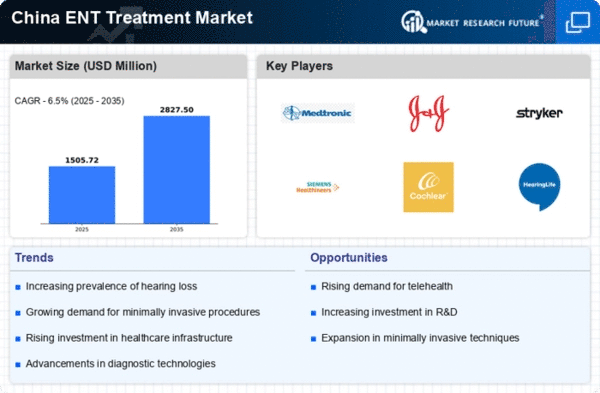

Innovations in medical technology are significantly influencing the ent treatment market in China. The introduction of minimally invasive surgical techniques, advanced imaging technologies, and robotic-assisted surgeries has transformed the landscape of ENT treatments. For example, the use of endoscopic procedures has increased, allowing for more precise diagnoses and treatments with reduced recovery times. The market for ENT devices, including hearing aids and surgical instruments, is projected to grow at a CAGR of 8% over the next five years. These technological advancements not only improve patient outcomes but also enhance the efficiency of healthcare providers, thereby driving the ent treatment market forward. As hospitals and clinics adopt these new technologies, the demand for specialized training and equipment is likely to rise, further stimulating market growth.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and quality are playing a crucial role in the ent treatment market. In recent years, the Chinese government has increased funding for healthcare infrastructure, particularly in rural areas where access to ENT specialists is limited. Programs designed to enhance medical training and provide subsidies for ENT treatments are also being implemented. For instance, the government has allocated approximately $1 billion to improve healthcare facilities and services in underserved regions. These initiatives not only aim to reduce the burden of ENT disorders but also encourage the establishment of specialized clinics and hospitals, thereby expanding the ent treatment market. As a result, patients are likely to benefit from improved access to quality care and a wider range of treatment options.

Increase in Health Insurance Coverage

The expansion of health insurance coverage in China is significantly impacting the ent treatment market. As more individuals gain access to health insurance, the financial barriers to seeking treatment for ENT disorders are reduced. Recent data indicates that health insurance penetration has reached approximately 95% of the population, facilitating greater access to medical services. This increase in coverage encourages patients to seek timely treatment for ENT conditions, which may have previously been neglected due to cost concerns. Consequently, the ent treatment market is likely to experience growth as more patients utilize their insurance benefits for ENT-related healthcare services. Additionally, insurance companies are increasingly covering advanced treatments and technologies, further driving the demand for innovative solutions within the ent treatment market.

Growing Demand for Preventive Healthcare

The shift towards preventive healthcare is emerging as a significant driver for the ent treatment market in China. With an increasing focus on early diagnosis and treatment, patients are becoming more proactive in seeking medical attention for ENT-related issues. This trend is reflected in the rising number of health check-ups and screenings that include ENT evaluations. According to recent surveys, nearly 40% of individuals in urban areas have undergone ENT screenings in the past year. This growing awareness of the importance of preventive care is likely to lead to earlier interventions and, consequently, a higher demand for various ENT treatments. As healthcare providers adapt to this trend, the ent treatment market is expected to expand, offering a wider array of preventive and therapeutic options.