Government Incentives and Funding

Government incentives and funding initiatives play a crucial role in shaping the energy storage market in China. The Chinese government has introduced various subsidies and financial support mechanisms to encourage the adoption of energy storage technologies. For instance, the 14th Five-Year Plan emphasizes the importance of energy storage in achieving energy transition goals. In 2023, the government allocated over $1 billion to support research and development in energy storage technologies. This financial backing not only stimulates innovation but also lowers the entry barriers for new players in the energy storage market, fostering a competitive landscape that is likely to attract further investments.

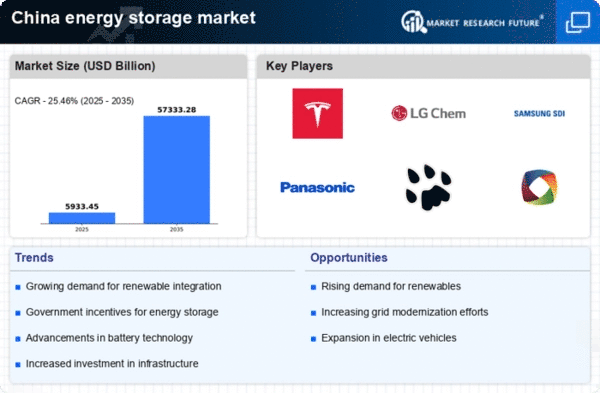

Rising Demand for Renewable Energy

The increasing demand for renewable energy sources in China is a pivotal driver for the energy storage market. As the country aims to achieve its ambitious targets of reaching 20% of its energy consumption from non-fossil sources by 2025, the need for energy storage solutions becomes more pronounced. Energy storage systems are essential for balancing supply and demand, particularly with the intermittent nature of solar and wind energy. In 2023, renewable energy accounted for approximately 30% of China's total energy generation, highlighting the growing reliance on these sources. This trend is expected to continue, thereby propelling the energy storage market forward as utilities and businesses seek to enhance grid stability and reliability.

Industrial Growth and Electrification

The rapid industrial growth in China, coupled with the ongoing electrification of various sectors, is significantly influencing the energy storage market. As industries increasingly adopt electric machinery and processes, the demand for reliable energy storage solutions rises. In 2023, the industrial sector accounted for nearly 70% of China's total energy consumption, indicating a substantial market for energy storage systems. This trend is expected to continue, as industries seek to enhance energy efficiency and reduce operational costs. Consequently, the energy storage market is likely to expand, driven by the need for systems that can provide backup power and manage peak loads effectively.

Urbanization and Smart City Initiatives

The rapid urbanization in China is driving the need for smart city initiatives, which in turn fuels the energy storage market. As cities expand, the demand for efficient energy management systems becomes critical. Smart city projects often incorporate energy storage solutions to optimize energy use, enhance grid resilience, and support renewable energy integration. In 2023, over 100 cities in China were actively pursuing smart city initiatives, with energy storage systems being a key component. This trend suggests a growing recognition of the importance of energy storage in urban planning, potentially leading to increased investments and developments in the energy storage market.

Technological Innovations in Energy Storage

Technological innovations are transforming the energy storage market in China, leading to more efficient and cost-effective solutions. Advances in battery technologies, such as lithium-ion and solid-state batteries, are enhancing energy density and lifespan, making them more attractive for various applications. In 2023, the average cost of lithium-ion batteries fell to approximately $150 per kWh, a significant reduction that has spurred adoption across multiple sectors. These innovations not only improve performance but also contribute to the overall growth of the energy storage market, as businesses and consumers increasingly recognize the value of integrating advanced storage solutions into their energy systems.