Investment in Battery Technology

Investment in innovative battery technologies is a crucial factor influencing the electric vehicles-battery market. In China, substantial investments are being made in research and development to enhance battery performance, longevity, and safety. For instance, companies are focusing on solid-state batteries, which promise higher energy densities and faster charging times. The Chinese government has allocated over $10 billion to support battery technology advancements, indicating a strong commitment to fostering innovation in this sector. As these technologies mature, they are expected to significantly improve the efficiency and appeal of electric vehicles, thereby propelling the electric vehicles-battery market forward.

Government Regulations on Emissions

Stringent government regulations regarding emissions are a significant driver of the electric vehicles-battery market. In China, the government has implemented strict policies aimed at reducing carbon emissions from the transportation sector. These regulations include mandates for automakers to produce a certain percentage of electric vehicles, which has led to an increased focus on battery production. As a result, manufacturers are compelled to invest in more efficient battery technologies to comply with these regulations. The electric vehicles-battery market is likely to see accelerated growth as companies adapt to these regulatory pressures and innovate to meet the new standards.

Rising Demand for Electric Vehicles

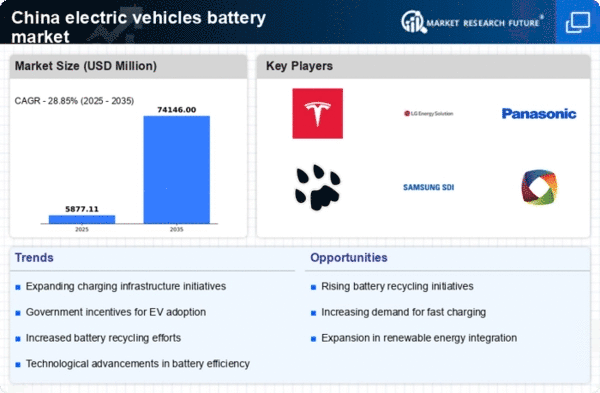

The increasing consumer preference for electric vehicles is a primary driver of the electric vehicles-battery market. In China, the demand for electric vehicles has surged, with sales reaching approximately 6 million units in 2025, representing a growth of over 30% from the previous year. This trend is fueled by a growing awareness of environmental issues and the desire for sustainable transportation options. As consumers become more environmentally conscious, the shift towards electric vehicles is expected to continue, thereby driving the demand for advanced battery technologies. The electric vehicles-battery market is likely to benefit from this rising demand, as manufacturers strive to meet the needs of a more eco-friendly consumer base.

Infrastructure Development for Charging Stations

The expansion of charging infrastructure is vital for the growth of the electric vehicles-battery market. In China, the government has set ambitious targets to install over 1 million public charging stations by 2025. This initiative aims to alleviate range anxiety among potential electric vehicle buyers and encourage more consumers to transition to electric mobility. The availability of convenient and accessible charging options is likely to enhance the attractiveness of electric vehicles, thereby stimulating demand for batteries. As the charging network expands, it is anticipated that the electric vehicles-battery market will experience a corresponding increase in growth, driven by improved consumer confidence.

Collaboration Between Automakers and Battery Manufacturers

Collaborative efforts between automakers and battery manufacturers are shaping the landscape of the electric vehicles-battery market. In China, partnerships are emerging to enhance battery technology and production capabilities. For example, major automotive companies are teaming up with battery producers to develop customized battery solutions that meet specific vehicle requirements. This collaboration not only streamlines the supply chain but also fosters innovation in battery design and performance. As these partnerships strengthen, the electric vehicles-battery market is expected to benefit from improved product offerings and increased efficiency in battery production.