Rising Environmental Awareness

Rising environmental awareness among consumers is significantly influencing the China Electric Vehicle Supply Equipment Market. As concerns about air pollution and climate change intensify, more individuals are opting for electric vehicles as a sustainable alternative to traditional gasoline-powered cars. This shift in consumer behavior is driving demand for electric vehicle supply equipment, as users seek reliable and efficient charging solutions. Additionally, the Chinese government has been actively promoting green initiatives, which further reinforces the commitment to reducing carbon emissions. The increasing emphasis on sustainability is likely to create a robust market for electric vehicle supply equipment, as both consumers and businesses align their practices with environmentally friendly standards.

Government Incentives and Support

Government incentives and support play a crucial role in driving the China Electric Vehicle Supply Equipment Market. The Chinese government has implemented various policies, including subsidies for electric vehicle purchases and tax exemptions for charging infrastructure development. These incentives are designed to encourage both consumers and businesses to invest in electric vehicles and the necessary charging equipment. As of January 2026, the government has allocated substantial funding to support the expansion of charging networks, which is expected to reach 2 million charging points by 2025. This proactive approach not only stimulates market growth but also fosters a favorable environment for manufacturers and service providers within the China Electric Vehicle Supply Equipment Market.

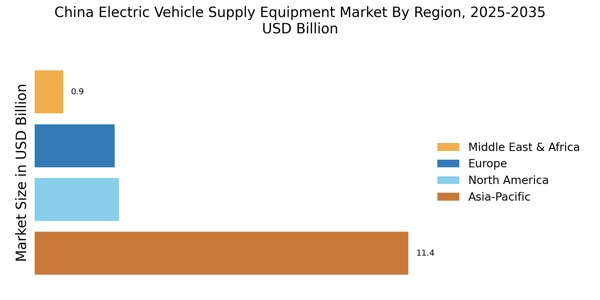

Urbanization and Population Growth

Urbanization and population growth in China are significant factors contributing to the expansion of the China Electric Vehicle Supply Equipment Market. As urban areas continue to grow, the demand for efficient transportation solutions becomes more pressing. The increasing population in cities is likely to lead to a higher number of electric vehicles on the road, necessitating the development of adequate charging infrastructure. By 2026, it is projected that urban areas will account for over 70% of the total electric vehicle market in China. This urban-centric growth presents opportunities for electric vehicle supply equipment manufacturers to cater to the specific needs of densely populated regions, thereby driving market expansion.

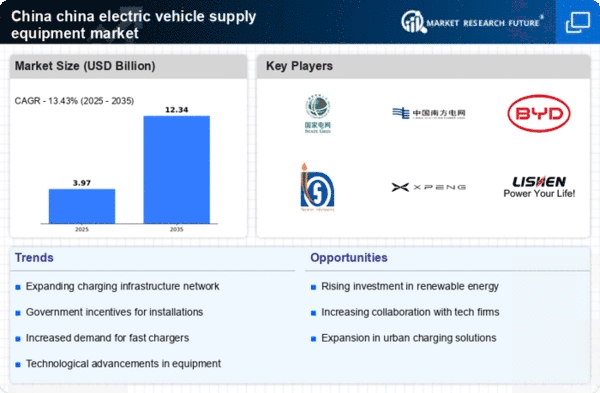

Expansion of Charging Infrastructure

The rapid expansion of charging infrastructure in China is a pivotal driver for the China Electric Vehicle Supply Equipment Market. As of January 2026, the number of public charging stations has surpassed 1.5 million, reflecting a significant increase in accessibility for electric vehicle users. This growth is largely attributed to government initiatives aimed at promoting electric vehicle adoption, which include investments in charging networks across urban and rural areas. The availability of charging stations not only alleviates range anxiety among consumers but also encourages the purchase of electric vehicles, thereby stimulating demand for electric vehicle supply equipment. Furthermore, partnerships between private companies and local governments are likely to enhance the development of charging infrastructure, ensuring that the China Electric Vehicle Supply Equipment Market continues to thrive.

Technological Advancements in Charging Solutions

Technological advancements in charging solutions are transforming the landscape of the China Electric Vehicle Supply Equipment Market. Innovations such as ultra-fast charging technology and wireless charging systems are emerging, which could potentially reduce charging times significantly. For instance, ultra-fast chargers can deliver up to 350 kW, allowing electric vehicles to charge to 80% in under 15 minutes. This rapid evolution in technology not only enhances user convenience but also aligns with the growing demand for efficient charging solutions. As manufacturers invest in research and development, the market is likely to witness a surge in the adoption of advanced charging technologies, further propelling the growth of the China Electric Vehicle Supply Equipment Market.