Growing E-commerce Sector

The direct carrier-billing market is poised for growth due to the expanding e-commerce sector in China. As online shopping continues to gain traction, consumers are increasingly seeking convenient payment options that facilitate quick transactions. In 2025, the e-commerce market in China is projected to surpass $2 trillion, with a significant portion of these transactions likely to utilize direct carrier billing. This payment method allows consumers to make purchases without the need for traditional banking methods, appealing to a wide range of users, including those without access to credit cards. As e-commerce platforms integrate direct carrier billing into their payment options, the market is expected to experience substantial growth, driven by the increasing volume of online transactions.

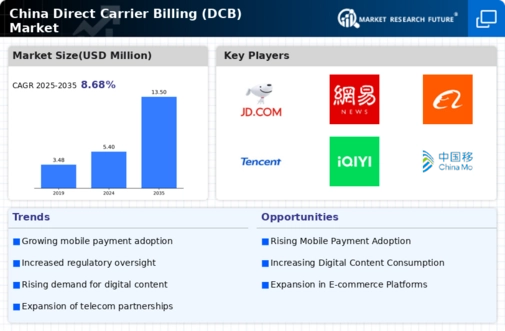

Increasing Mobile Payment Adoption

The direct carrier-billing market in China is experiencing a notable surge due to the increasing adoption of mobile payment solutions. As consumers become more accustomed to using their smartphones for transactions, the convenience of direct carrier billing is becoming more appealing. In 2025, mobile payment transactions in China are projected to exceed $5 trillion, indicating a robust growth trajectory. This trend is likely to drive the direct carrier-billing market, as it offers a seamless payment experience for digital goods and services. Furthermore, the integration of direct carrier billing with popular mobile payment platforms enhances its visibility and accessibility, potentially attracting a broader user base. As more consumers opt for mobile payments, the direct carrier-billing market is poised to benefit significantly from this shift in consumer behavior.

Expansion of Digital Content Services

The direct carrier-billing market is being propelled by the rapid expansion of digital content services in China. With the increasing demand for streaming services, mobile games, and e-books, consumers are seeking convenient payment methods to access these offerings. In 2025, the digital content market in China is expected to reach $50 billion, with a substantial portion of transactions likely facilitated through direct carrier billing. This method allows users to charge purchases directly to their mobile accounts, eliminating the need for credit cards or bank accounts. As digital content providers recognize the advantages of integrating direct carrier billing, the market is likely to witness enhanced partnerships and collaborations, further solidifying its position within the broader digital economy.

Rising Demand for Seamless User Experience

In the context of the direct carrier-billing market, the demand for a seamless user experience is becoming increasingly critical. Consumers in China are looking for frictionless payment solutions that do not disrupt their engagement with digital content. Direct carrier billing offers a streamlined process, allowing users to make purchases with just a few taps on their devices. This ease of use is particularly appealing to younger demographics, who prioritize convenience and speed in their transactions. As user expectations evolve, service providers are likely to enhance their offerings to include direct carrier billing, thereby improving customer satisfaction and retention. The emphasis on user experience is expected to drive growth in the direct carrier-billing market, as more businesses adopt this payment method to meet consumer demands.

Technological Advancements in Mobile Networks

The direct carrier-billing market is benefiting from ongoing technological advancements in mobile networks across China. The rollout of 5G technology is expected to enhance the overall mobile experience, enabling faster and more reliable transactions. As mobile network infrastructure improves, the direct carrier-billing market is likely to see increased adoption rates, as consumers will be able to complete transactions with minimal latency. Additionally, advancements in mobile security protocols may further bolster consumer confidence in using direct carrier billing for their purchases. The combination of improved network capabilities and enhanced security measures could create a more favorable environment for the direct carrier-billing market, potentially leading to higher transaction volumes and revenue growth.