Cost Efficiency and Accessibility

Cost efficiency is emerging as a pivotal driver for the dental 3d-printing market in China. The ability to produce dental appliances in-house reduces outsourcing costs and minimizes lead times, making dental care more accessible to a broader population. With the average cost of dental procedures in China being relatively high, the adoption of 3D printing technologies can lead to significant savings for both dental practices and patients. Reports suggest that practices utilizing 3D printing can reduce production costs by up to 50%, thereby making dental services more affordable. This cost-effectiveness is likely to encourage more dental clinics to invest in 3D printing technologies, thereby expanding the market and improving patient access to quality dental care.

Rising Demand for Aesthetic Dentistry

The growing consumer awareness regarding aesthetic dentistry is significantly influencing the dental 3d-printing market in China. Patients are increasingly seeking cosmetic dental procedures, such as veneers and orthodontic aligners, which require precise and customized solutions. This trend is expected to drive the demand for 3D-printed dental products, as they offer superior fit and comfort compared to traditional methods. The market for aesthetic dentistry in China is anticipated to reach approximately $10 billion by 2026, with a substantial portion attributed to 3D printing technologies. As dental practitioners strive to meet patient expectations for aesthetic outcomes, the adoption of 3D printing solutions is likely to accelerate, further propelling the growth of the dental 3d-printing market.

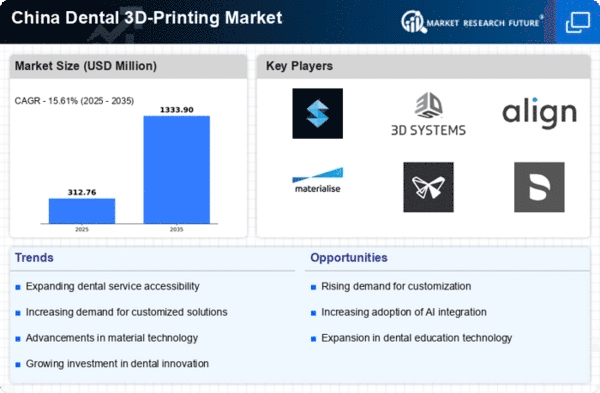

Growing Investment in Dental Technology

Investment in dental technology is on the rise in China, which is positively impacting the dental 3d-printing market. Both private and public sectors are recognizing the potential of advanced dental technologies, leading to increased funding and support for research and development. This influx of investment is facilitating the development of innovative 3D printing materials and techniques tailored for dental applications. As a result, the market is expected to witness a compound annual growth rate (CAGR) of around 20% over the next five years. Furthermore, educational institutions are incorporating 3D printing into their dental curricula, ensuring that future dental professionals are well-versed in these technologies, which will further drive market growth.

Technological Advancements in 3D Printing

The dental 3d-printing market in China is experiencing a surge due to rapid technological advancements. Innovations in 3D printing technologies, such as digital light processing (DLP) and selective laser sintering (SLS), are enhancing the precision and efficiency of dental applications. These technologies allow for the production of highly accurate dental models, crowns, and bridges, which are crucial for effective dental treatments. The market is projected to grow at a CAGR of approximately 25% from 2025 to 2030, driven by these advancements. Furthermore, the integration of artificial intelligence in 3D printing processes is streamlining workflows, reducing production times, and minimizing errors, thereby increasing the overall productivity of dental practices. As a result, dental professionals are increasingly adopting these technologies, contributing to the expansion of the dental 3d-printing market.

Increasing Regulatory Support for 3D Printing

Regulatory support is becoming increasingly important for the dental 3d-printing market in China. The government is actively promoting the adoption of advanced manufacturing technologies, including 3D printing, through favorable policies and guidelines. This support is aimed at enhancing the quality and safety of dental products, which is crucial for gaining consumer trust. Recent initiatives have streamlined the approval processes for 3D-printed dental devices, making it easier for manufacturers to bring their products to market. As a result, the dental 3d-printing market is likely to benefit from a more conducive regulatory environment, encouraging innovation and investment in this sector.