Rising Cybersecurity Concerns

As cyber threats continue to evolve, the need for robust cybersecurity measures in data centers is becoming increasingly critical in China. The data center-life-cycle-services market is being driven by the demand for comprehensive security solutions that protect sensitive data and ensure compliance with regulations. In 2025, it is projected that cybersecurity spending in the data center sector will exceed $10 billion, reflecting a growing recognition of the importance of safeguarding digital assets. Life-cycle services that include security assessments, incident response planning, and ongoing monitoring are essential for mitigating risks. This heightened focus on cybersecurity is likely to propel the data center-life-cycle-services market as organizations prioritize the protection of their infrastructure.

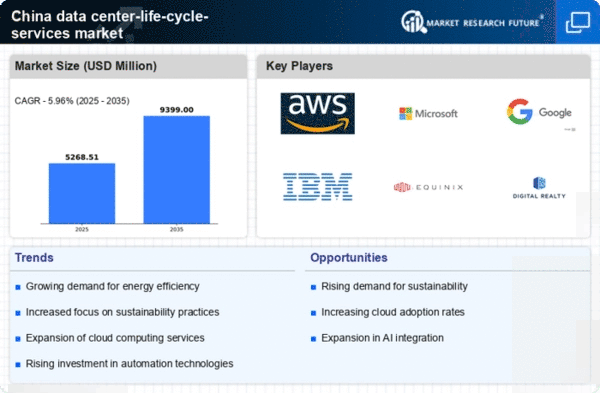

Growing Demand for Cloud Services

The increasing adoption of cloud computing in China is a primary driver for the data center-life-cycle-services market. As businesses migrate to cloud-based solutions, the need for efficient data center operations becomes paramount. In 2025, the cloud services market in China is projected to reach approximately $50 billion, reflecting a growth rate of around 30% annually. This surge necessitates enhanced life-cycle services to ensure optimal performance, reliability, and scalability of data centers. Companies are investing in life-cycle management to streamline operations, reduce downtime, and improve service delivery. Consequently, the data center-life-cycle-services market is likely to experience significant growth as organizations seek to optimize their cloud infrastructures.

Government Initiatives and Support

The Chinese government is actively promoting the development of data centers through various initiatives and policies, which is positively impacting the data center-life-cycle-services market. Investments in digital infrastructure and smart city projects are expected to drive demand for data center services. In 2025, government funding for data center projects is anticipated to reach approximately $15 billion, aimed at enhancing technological capabilities and fostering innovation. These initiatives encourage the adoption of advanced life-cycle services to ensure that data centers meet the evolving needs of businesses and consumers. As a result, the data center-life-cycle-services market is likely to benefit from increased government support and investment.

Increased Focus on Energy Efficiency

Energy efficiency has emerged as a critical concern for data centers in China, driving the demand for life-cycle services. With energy costs rising and environmental regulations tightening, operators are compelled to adopt more sustainable practices. The data center sector in China consumes approximately 2% of the national electricity supply, prompting a shift towards energy-efficient technologies. Life-cycle services that focus on energy optimization, such as cooling solutions and power management, are becoming essential. By implementing these services, data centers can reduce operational costs and minimize their carbon footprint, thereby enhancing their competitiveness in the market. This trend is expected to propel the data center-life-cycle-services market forward.

Technological Advancements in Infrastructure

Rapid technological advancements in data center infrastructure are significantly influencing the data center-life-cycle-services market. Innovations such as artificial intelligence, machine learning, and automation are transforming how data centers operate. In 2025, it is estimated that over 60% of data centers in China will incorporate AI-driven management systems, enhancing operational efficiency and predictive maintenance. These technologies enable data centers to optimize resource allocation, reduce operational risks, and improve service quality. As organizations increasingly adopt these advanced technologies, the demand for specialized life-cycle services that can support and integrate these innovations is likely to rise, further driving market growth.