Rise of AI-Driven Solutions

Artificial intelligence is increasingly becoming a cornerstone of the China cybersecurity market. The integration of AI technologies into cybersecurity solutions enhances threat detection and response capabilities, allowing organizations to proactively address potential vulnerabilities. In 2025, it is estimated that AI-driven cybersecurity solutions will account for nearly 30% of the total market share, driven by advancements in machine learning and data analytics. This trend indicates a shift towards more sophisticated security measures, as AI can analyze vast amounts of data in real-time, identifying anomalies that may signify cyber threats. Consequently, the rise of AI-driven solutions is likely to reshape the competitive landscape of the China cybersecurity market.

Growing Cyber Threat Landscape

The evolving cyber threat landscape poses significant challenges for the China cybersecurity market. With the increasing sophistication of cyberattacks, including ransomware and phishing schemes, organizations are compelled to enhance their cybersecurity measures. In 2025, it is projected that the number of reported cyber incidents will rise by 25%, prompting businesses to allocate more resources towards cybersecurity solutions. This growing threat landscape not only drives demand for advanced security technologies but also necessitates continuous investment in employee training and awareness programs. As organizations strive to protect sensitive data and maintain operational integrity, the urgency to address these threats will likely propel the growth of the China cybersecurity market.

Regulatory Framework Enhancement

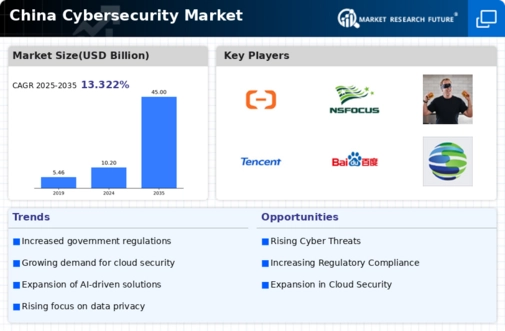

The regulatory landscape surrounding the China cybersecurity market is undergoing substantial transformation. The Chinese government has implemented a series of stringent cybersecurity laws and regulations, such as the Cybersecurity Law of 2017 and the Data Security Law of 2021. These regulations mandate that organizations prioritize data protection and cybersecurity measures, thereby driving demand for cybersecurity solutions. As of 2025, the market is projected to reach approximately USD 45 billion, reflecting a compound annual growth rate of around 15%. This regulatory push not only compels businesses to invest in cybersecurity but also fosters a culture of compliance, which is essential for the growth of the China cybersecurity market.

Digital Transformation Initiatives

The ongoing digital transformation across various industries in China is a key driver of the cybersecurity market. As organizations increasingly adopt cloud computing, IoT devices, and digital platforms, the need for robust cybersecurity measures becomes paramount. By 2025, it is estimated that over 70% of enterprises in China will have undergone some form of digital transformation, leading to a heightened focus on cybersecurity. This shift not only creates new vulnerabilities but also presents opportunities for cybersecurity firms to offer tailored solutions that address specific industry needs. Consequently, the digital transformation initiatives are likely to catalyze growth in the China cybersecurity market, as businesses seek to safeguard their digital assets.

Increased Collaboration Between Sectors

Collaboration among various sectors is becoming increasingly vital in the China cybersecurity market. Government agencies, private enterprises, and academic institutions are forming partnerships to share information and resources, thereby enhancing overall cybersecurity resilience. For instance, initiatives such as the National Cybersecurity Center promote knowledge exchange and joint efforts in combating cyber threats. This collaborative approach not only strengthens the cybersecurity posture of individual organizations but also contributes to a more secure digital ecosystem across the nation. As of 2025, it is anticipated that collaborative efforts will lead to a 20% increase in the effectiveness of cybersecurity measures implemented across different sectors, underscoring the importance of synergy in the China cybersecurity market.