Expansion of Distribution Channels

The expansion of distribution channels is playing a crucial role in the growth of the china contact intraocular lenses market. With the rise of e-commerce and online retail platforms, patients now have greater access to a variety of intraocular lens options. This shift is particularly significant in urban areas, where consumers are increasingly turning to online platforms for convenience and competitive pricing. Additionally, partnerships between manufacturers and healthcare providers are enhancing the availability of contact intraocular lenses in clinics and hospitals. As distribution networks continue to evolve, the market is likely to experience increased penetration, making these products more accessible to a wider audience across China.

Rising Prevalence of Eye Disorders

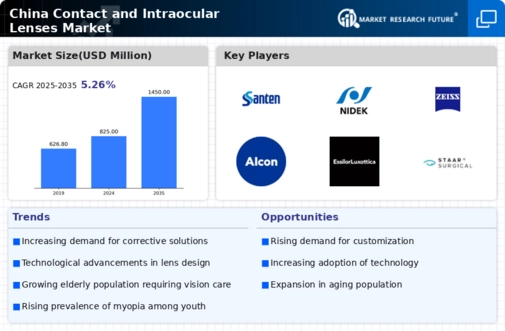

The increasing incidence of eye disorders in China is a pivotal driver for the china contact intraocular lenses market. With an estimated 80 million individuals affected by various forms of visual impairment, the demand for corrective solutions is surging. Conditions such as cataracts and myopia are particularly prevalent, prompting a greater need for intraocular lenses. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, reflecting the urgent need for effective vision correction. This trend is further supported by the growing awareness of eye health and the importance of early intervention, which is likely to bolster the adoption of contact intraocular lenses across diverse demographics in China.

Technological Innovations in Lens Design

Technological advancements in lens design and materials are transforming the china contact intraocular lenses market. Innovations such as the development of multifocal and toric lenses are enhancing the quality of vision correction, catering to a broader range of visual impairments. The introduction of biocompatible materials has also improved patient comfort and reduced the risk of complications. As manufacturers continue to invest in research and development, the market is expected to expand, with new products entering the market that offer superior performance. This trend is likely to attract a growing number of ophthalmologists and patients, further driving the demand for contact intraocular lenses in China.

Government Initiatives and Healthcare Policies

Government initiatives aimed at enhancing healthcare access and affordability are significantly influencing the china contact intraocular lenses market. The Chinese government has implemented various policies to improve eye care services, including subsidies for cataract surgeries and the promotion of advanced medical technologies. These initiatives are designed to alleviate the financial burden on patients and encourage the adoption of innovative solutions such as contact intraocular lenses. Furthermore, the Healthy China 2030 initiative emphasizes the importance of vision health, which is expected to drive investments in eye care infrastructure and services. As a result, the market is likely to witness increased growth opportunities, particularly in rural areas where access to eye care has historically been limited.

Increasing Disposable Income and Consumer Awareness

The rise in disposable income among the Chinese population is contributing to the growth of the china contact intraocular lenses market. As more individuals attain higher income levels, there is a corresponding increase in spending on healthcare and vision correction solutions. Additionally, consumer awareness regarding the benefits of contact intraocular lenses is on the rise, driven by educational campaigns and improved access to information. This heightened awareness is encouraging patients to seek advanced solutions for their vision problems, thereby boosting market demand. The combination of increased purchasing power and informed consumer choices is likely to propel the market forward, creating a favorable environment for manufacturers and healthcare providers alike.