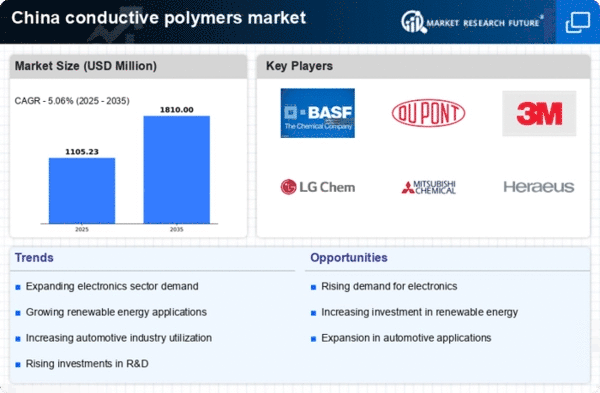

The conductive polymers market in China is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as electronics, automotive, and renewable energy. Key players are actively engaging in strategies that emphasize innovation, regional expansion, and sustainability. For instance, BASF SE (DE) has been focusing on enhancing its product portfolio through research and development, aiming to meet the growing needs for advanced materials. Similarly, DuPont (US) is leveraging its expertise in material science to develop high-performance conductive polymers, positioning itself as a leader in the market. These strategies collectively contribute to a competitive environment that is increasingly shaped by technological advancements and sustainability initiatives.In terms of business tactics, companies are localizing manufacturing to better serve the Chinese market, which appears to be a response to the increasing demand for customized solutions. Supply chain optimization is also a critical focus, as firms seek to enhance efficiency and reduce costs. The market structure is moderately fragmented, with several key players exerting significant influence. This fragmentation allows for a variety of competitive strategies, enabling companies to differentiate themselves through innovation and customer service.

In October 3M Company (US) announced a strategic partnership with a leading Chinese electronics manufacturer to co-develop next-generation conductive polymer solutions. This collaboration is expected to enhance 3M's market presence in China while providing the partner with access to advanced materials that could improve their product offerings. The strategic importance of this partnership lies in its potential to accelerate innovation and expand market reach in a rapidly evolving sector.

In September LG Chem (KR) unveiled a new line of eco-friendly conductive polymers aimed at the automotive industry. This initiative reflects the company's commitment to sustainability and positions it favorably in a market increasingly focused on environmentally friendly solutions. The introduction of these products is likely to attract customers who prioritize sustainability, thereby enhancing LG Chem's competitive edge.

In August Heraeus Holding (DE) expanded its production capabilities in China by investing in a new manufacturing facility dedicated to conductive polymers. This move is indicative of Heraeus's long-term commitment to the region and its strategy to meet the rising demand for advanced materials. The establishment of this facility is expected to improve supply chain efficiency and reduce lead times, which are critical factors in maintaining competitiveness in the market.

As of November current trends in the conductive polymers market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming increasingly important, as companies recognize the value of collaboration in driving innovation and enhancing product offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, innovation, and supply chain reliability. This shift suggests that companies that prioritize these areas will be better positioned to thrive in the future.