Surge in Data Generation

the computing power market is experiencing a notable surge in data generation, driven by the proliferation of IoT devices and digital services. As of 2025, it is estimated that the volume of data generated in China will reach approximately 10 zettabytes, necessitating enhanced computing capabilities to process and analyze this information. This trend is compelling businesses to invest in advanced computing infrastructure, thereby propelling the demand for high-performance computing solutions. The increasing reliance on data analytics across various sectors, including finance, healthcare, and manufacturing, further underscores the critical need for robust computing power. Consequently, this driver is likely to shape the landscape of the computing power market, as organizations seek to harness data for strategic decision-making and operational efficiency.

Expansion of 5G Technology

The rollout of 5G technology in China is poised to have a transformative impact on the computing power market. With its high-speed connectivity and low latency, 5G is expected to facilitate the deployment of advanced applications such as augmented reality, virtual reality, and real-time data processing. By 2025, it is anticipated that 5G networks will cover over 90% of urban areas in China, significantly increasing the demand for computing power to support these applications. This expansion is likely to drive investments in edge computing solutions, as businesses seek to process data closer to the source to enhance performance and reduce latency. As a result, the computing power market is expected to witness substantial growth, driven by the need for infrastructure that can support the demands of a 5G-enabled ecosystem.

Rising Cybersecurity Concerns

As the digital landscape evolves, cybersecurity concerns are becoming increasingly prominent in China, influencing the computing power market. The rise in cyber threats and data breaches has prompted organizations to invest heavily in advanced security measures, which in turn requires enhanced computing capabilities. By 2025, it is projected that cybersecurity spending in China will reach approximately $30 billion, reflecting the urgent need for robust computing power to support security protocols and threat detection systems. This trend indicates that businesses are prioritizing the integration of security into their computing infrastructure, thereby driving demand for high-performance computing solutions that can handle complex security algorithms and real-time monitoring. Consequently, the computing power market is likely to expand as organizations seek to fortify their defenses against evolving cyber threats.

Government Initiatives and Investments

The Chinese government is actively promoting the development of the computing power market through various initiatives and investments. In recent years, substantial funding has been allocated to enhance the country's computing infrastructure, with a focus on fostering innovation in semiconductor technology and cloud computing services. For instance, the government aims to increase domestic production of semiconductors to reduce reliance on foreign technology, which is expected to bolster the computing power market. By 2025, government investments in this sector are projected to exceed $100 billion, indicating a strong commitment to establishing China as a leader in computing technology. This supportive policy environment is likely to stimulate growth and attract private sector participation, thereby enhancing the overall competitiveness of the computing power market.

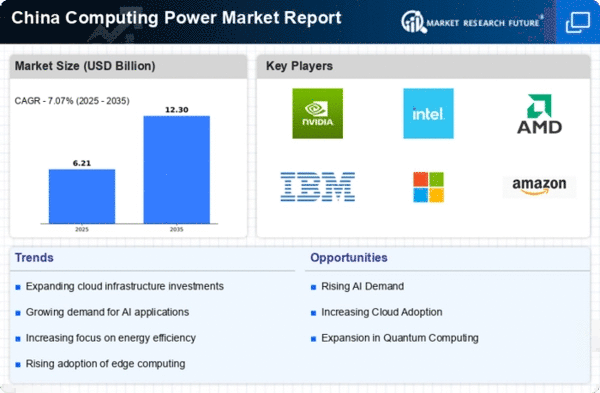

Increased Adoption of Quantum Computing

The computing power market in China is witnessing a growing interest in quantum computing, which holds the potential to revolutionize various industries. As research and development in quantum technologies advance, Chinese companies and research institutions are increasingly exploring applications in fields such as cryptography, materials science, and complex system simulations. By 2025, investments in quantum computing are expected to surpass $10 billion, indicating a strong commitment to harnessing this cutting-edge technology. The unique capabilities of quantum computing, such as solving complex problems at unprecedented speeds, are likely to create new opportunities within the computing power market. This driver suggests that as quantum technologies mature, they may significantly alter the competitive landscape, compelling traditional computing power providers to adapt and innovate.