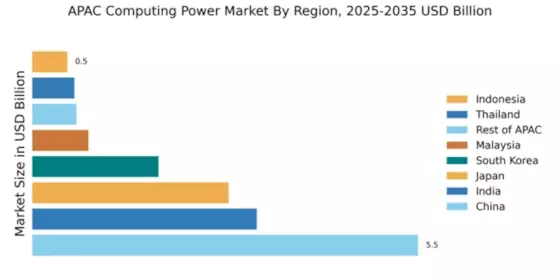

China : Unmatched Growth and Innovation

China holds a commanding 5.5% market share in the APAC computing power sector, driven by rapid advancements in AI, cloud computing, and big data analytics. The government's supportive policies, such as the 'Made in China 2025' initiative, aim to enhance technological self-sufficiency. Infrastructure investments in data centers and 5G networks further bolster demand, catering to a growing consumer base that increasingly relies on digital services.

India : Rapid Growth and Digital Transformation

India's computing power market is valued at 3.2%, fueled by a burgeoning startup ecosystem and increasing internet penetration. The Digital India initiative promotes digital infrastructure, enhancing demand for cloud services and data analytics. With a young population and rising disposable incomes, consumption patterns are shifting towards online services, creating a robust market environment for tech companies.

Japan : Strong Focus on R&D and AI

Japan's computing power market stands at 2.8%, characterized by a strong emphasis on research and development. The government supports innovation through funding and partnerships with private sectors, particularly in AI and robotics. Demand for high-performance computing is rising, driven by industries such as automotive and healthcare, which are increasingly adopting advanced technologies.

South Korea : Leading in 5G and Cloud Services

South Korea captures 1.8% of the APAC computing power market, bolstered by its advanced telecommunications infrastructure and high-speed internet. The government promotes digital transformation through initiatives like the 'K-Digital Strategy,' enhancing cloud adoption across sectors. Major cities like Seoul and Busan are key markets, with significant investments in data centers and AI technologies.

Malaysia : Strategic Location for Tech Firms

Malaysia's computing power market is valued at 0.8%, driven by its strategic location and government initiatives like the Malaysia Digital Economy Corporation. The country is becoming a hub for data centers, attracting foreign investments. Demand is growing in sectors such as e-commerce and fintech, with Kuala Lumpur emerging as a key market for tech companies.

Thailand : Focus on Digital Transformation

Thailand's computing power market, at 0.6%, is evolving with a focus on digital transformation. The government’s Thailand 4.0 initiative aims to boost the digital economy, enhancing demand for cloud services and data analytics. Key cities like Bangkok are witnessing increased investments in tech infrastructure, catering to a growing consumer base that values digital solutions.

Indonesia : Rapid Growth in Digital Services

Indonesia's computing power market is valued at 0.5%, with significant growth potential driven by increasing internet penetration and a young population. The government is promoting digital initiatives to enhance infrastructure, particularly in urban areas like Jakarta. Local startups are emerging, creating demand for cloud computing and data analytics services.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a market share of 0.63%, characterized by diverse economic conditions and varying levels of technological adoption. Countries in this category are increasingly investing in digital infrastructure, driven by local demand for computing power. The competitive landscape includes both global and regional players, adapting to unique market dynamics and consumer preferences.