Surge in Mobile Device Usage

The surge in mobile device usage in China is significantly impacting the communications interface market. With over 1 billion smartphone users, the demand for seamless communication solutions is at an all-time high. This trend is driving manufacturers to innovate and develop advanced communication interfaces that cater to the needs of mobile users. The market for mobile communication interfaces is projected to grow by approximately 30% over the next five years. Additionally, the rise of mobile applications and services is further fueling this demand, as users seek faster and more reliable communication options. Consequently, the communications interface market is likely to experience robust growth, driven by the increasing reliance on mobile technology.

Adoption of Smart Technologies

The adoption of smart technologies across various sectors in China is a significant driver for the communications interface market. Industries such as manufacturing, healthcare, and transportation are increasingly integrating smart solutions to enhance efficiency and productivity. The implementation of smart technologies necessitates advanced communication interfaces that can support real-time data exchange and connectivity. As a result, the market is expected to witness a growth rate of around 20% in the coming years. Furthermore, the rise of smart homes and IoT devices is likely to create additional demand for innovative communication solutions, thereby propelling the communications interface market forward. This trend indicates a shift towards more interconnected systems, emphasizing the need for robust communication infrastructure.

Focus on Enhanced User Experience

The focus on enhanced user experience is driving innovation within the communications interface market in China. As consumers become more tech-savvy, their expectations for communication solutions evolve. Companies are increasingly prioritizing user-friendly interfaces and seamless connectivity to meet these demands. This shift is likely to result in the development of more intuitive communication platforms, which could lead to a market growth of approximately 15% over the next few years. Additionally, the emphasis on user experience is prompting investments in research and development, as businesses strive to differentiate themselves in a competitive landscape. Consequently, the communications interface market is expected to thrive as companies adapt to changing consumer preferences.

Government Initiatives and Policies

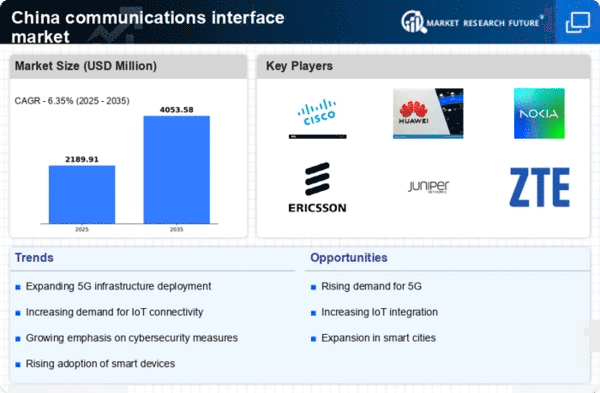

Government initiatives play a crucial role in shaping the communications interface market in China. Policies aimed at promoting digital transformation and technological innovation are fostering a conducive environment for market growth. The Chinese government has set ambitious targets for digital infrastructure, including the rollout of 5G networks and the development of smart cities. These initiatives are expected to attract investments exceeding $100 billion in the next few years. Furthermore, regulatory support for telecommunications companies is likely to enhance competition and innovation within the communications interface market. As a result, the market is poised for substantial growth, driven by favorable government policies and strategic investments.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in China is a primary driver for the communications interface market. As urbanization accelerates, the need for robust communication infrastructure becomes paramount. The Chinese government has invested heavily in 5G technology, aiming to cover 90% of urban areas by 2025. This investment is expected to boost the communications interface market significantly, with projections indicating a growth rate of approximately 25% annually. Enhanced connectivity facilitates various applications, including smart cities and telemedicine, which further propels market expansion. The integration of high-speed networks is likely to enhance user experiences and drive the adoption of advanced communication technologies, thereby solidifying the market's growth trajectory.