Rising Cybersecurity Threats

The cloud workload-protection market in China is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to enhance their security measures to protect sensitive data and applications hosted in the cloud. In 2025, it is estimated that cybercrime could cost the Chinese economy over $1 trillion, prompting businesses to invest in robust cloud workload-protection solutions. This trend indicates a heightened awareness of the need for comprehensive security strategies, as companies seek to mitigate risks associated with data breaches and ransomware attacks. Consequently, the demand for advanced security solutions within the cloud workload-protection market is likely to escalate, as organizations prioritize safeguarding their digital assets against evolving threats.

Increased Regulatory Scrutiny

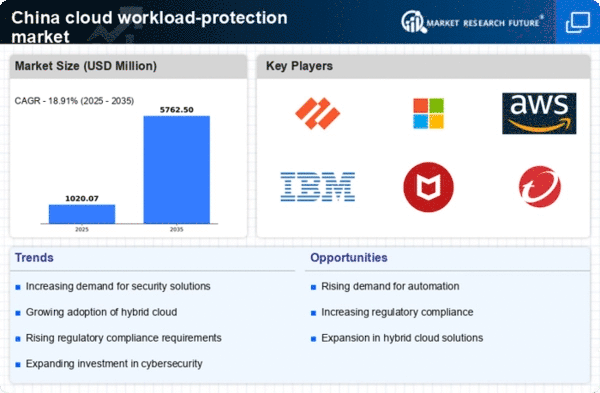

The cloud workload-protection market in China is also shaped by the growing regulatory scrutiny surrounding data protection and privacy. With the implementation of stringent regulations, such as the Personal Information Protection Law (PIPL), organizations are required to adopt comprehensive security measures to comply with legal standards. This regulatory environment is likely to drive investments in cloud workload-protection solutions, as companies strive to avoid hefty fines and reputational damage. In 2025, it is anticipated that compliance-related expenditures could account for up to 30% of IT budgets in China, further propelling the demand for effective workload protection strategies within the market.

Growing Awareness of Data Privacy

The cloud workload-protection market in China is witnessing a surge in demand driven by the growing awareness of data privacy among consumers and businesses alike. As data breaches become more prevalent, organizations are increasingly recognizing the importance of protecting sensitive information stored in the cloud. This heightened awareness is likely to influence purchasing decisions, with companies prioritizing solutions that ensure data integrity and confidentiality. In 2025, it is estimated that the data protection market in China will exceed $10 billion, reflecting the critical need for effective cloud workload-protection strategies. As a result, businesses are expected to invest significantly in technologies that enhance their data privacy measures, thereby propelling growth in the market.

Emergence of Hybrid Cloud Solutions

The rise of hybrid cloud solutions is a notable driver for the cloud workload-protection market in China. As organizations seek to leverage the benefits of both public and private clouds, the complexity of managing and securing workloads increases. This trend is expected to lead to a surge in demand for integrated protection solutions that can effectively safeguard data across diverse environments. By 2025, the hybrid cloud market in China is projected to grow at a CAGR of 25%, indicating a strong need for specialized cloud workload-protection services. Companies are likely to prioritize solutions that offer seamless security across hybrid infrastructures, thereby enhancing the overall resilience of their cloud operations.

Shift Towards Digital Transformation

The ongoing digital transformation across various sectors in China is significantly influencing the cloud workload-protection market. As businesses increasingly migrate their operations to the cloud, the need for effective protection mechanisms becomes paramount. In 2025, it is projected that the cloud services market in China will reach approximately $50 billion, driving the demand for specialized workload protection solutions. This shift not only enhances operational efficiency but also necessitates a robust security framework to protect cloud-based workloads. Organizations are likely to invest in innovative cloud workload-protection technologies to ensure seamless and secure digital operations, thereby fostering growth in the market.