Rising Consumer Awareness

Consumer awareness regarding the quality and safety of food and pharmaceuticals is on the rise in China, which is influencing the chiral chromatography-columns market. As consumers demand higher quality products, manufacturers are compelled to adopt advanced analytical techniques to ensure product integrity. This trend is likely to drive the adoption of chiral chromatography-columns, as they are essential for the analysis of chiral substances in food and drug products. The increasing focus on quality assurance is expected to contribute to a market growth rate of approximately 8% annually, reflecting the importance of chiral chromatography in meeting consumer expectations.

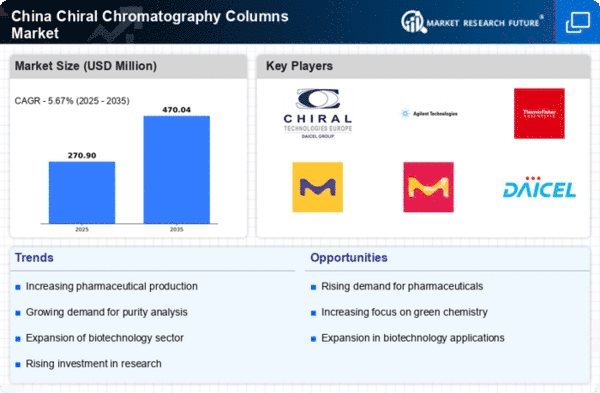

Growth in Biotechnology Sector

The biotechnology sector in China is witnessing rapid growth, which is positively impacting the chiral chromatography-columns market. As biopharmaceuticals gain traction, the need for effective separation techniques for chiral molecules becomes paramount. The market for biopharmaceuticals in China is projected to reach $100 billion by 2025, creating a substantial demand for chiral chromatography-columns. These columns are crucial for the purification and analysis of biologically active compounds, thus supporting the burgeoning biotechnology industry. The interplay between biotechnology advancements and the chiral chromatography-columns market indicates a promising future for both sectors.

Increasing Regulatory Compliance

The chiral chromatography-columns market in China is experiencing growth due to heightened regulatory compliance in the pharmaceutical and food industries. Regulatory bodies are enforcing stringent guidelines to ensure the safety and efficacy of chiral compounds. This has led to an increased demand for chiral chromatography-columns, which are essential for the separation and analysis of enantiomers. In 2025, the market is projected to reach approximately $150 million, driven by the need for compliance with regulations such as the China Food and Drug Administration (CFDA) standards. As companies strive to meet these regulations, investments in advanced chiral chromatography technology are likely to rise, further propelling the market forward.

Emerging Market for Green Chemistry

The chiral chromatography-columns market is also being influenced by the emerging focus on green chemistry practices in China. As industries strive to reduce their environmental impact, there is a growing interest in sustainable separation techniques. Chiral chromatography offers environmentally friendly alternatives for the separation of enantiomers, aligning with the principles of green chemistry. This shift is likely to attract investments in innovative chiral chromatography technologies, potentially leading to a market valuation of $200 million by 2025. The integration of sustainability into the chiral chromatography-columns market suggests a transformative approach to analytical chemistry in China.

Surge in Research and Development Activities

The chiral chromatography-columns market is benefiting from a surge in research and development (R&D) activities across various sectors in China. With a focus on drug discovery and development, pharmaceutical companies are increasingly utilizing chiral chromatography for the analysis of chiral drugs. In 2025, R&D spending in the pharmaceutical sector is expected to exceed $50 billion, indicating a robust investment in technologies that enhance analytical capabilities. This trend suggests that the demand for chiral chromatography-columns will continue to grow as researchers seek efficient methods for separating and analyzing chiral compounds, thereby driving market expansion.