Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and quality in China are significantly influencing the cardiovascular devices market. The Chinese government has launched various programs to enhance cardiovascular care, including funding for research and development of innovative medical devices. In 2023, the government allocated approximately $1 billion to support the development of advanced cardiovascular technologies. This financial backing is expected to stimulate innovation and increase the availability of cutting-edge devices in the market. Additionally, public health campaigns focused on cardiovascular health are likely to raise awareness and drive demand for these devices. Consequently, the cardiovascular devices market is anticipated to expand as a result of these supportive government measures.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in China is a crucial factor propelling the cardiovascular devices market. The government has been investing in the development of hospitals and clinics, particularly in rural areas, to improve access to healthcare services. This expansion is likely to facilitate the distribution and availability of cardiovascular devices, making them more accessible to a larger segment of the population. Additionally, the establishment of specialized cardiovascular centers is expected to enhance the quality of care and increase the adoption of advanced devices. As healthcare infrastructure continues to grow, the cardiovascular devices market is anticipated to flourish, driven by improved access and enhanced patient care.

Technological Innovations in Device Design

Technological innovations in the design and functionality of cardiovascular devices are transforming the market landscape in China. The introduction of minimally invasive procedures and advanced imaging technologies has enhanced the effectiveness of cardiovascular treatments. For instance, the development of bioresorbable stents and wearable heart monitors represents a significant leap forward in patient care. These innovations not only improve patient outcomes but also reduce recovery times, making them more appealing to both healthcare providers and patients. As a result, the cardiovascular devices market is likely to experience increased demand for these advanced solutions, reflecting a shift towards more patient-centric care models.

Rising Incidence of Cardiovascular Diseases

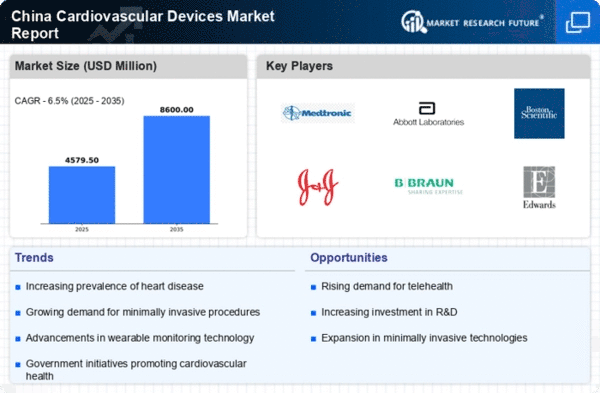

The increasing prevalence of cardiovascular diseases in China is a primary driver for the cardiovascular devices market. According to recent health statistics, cardiovascular diseases account for approximately 40% of all deaths in the country. This alarming trend necessitates the adoption of advanced cardiovascular devices for diagnosis and treatment. The demand for devices such as stents, pacemakers, and defibrillators is expected to rise significantly as healthcare providers seek to address this public health crisis. Furthermore, the Chinese government has been investing heavily in healthcare infrastructure, which is likely to enhance access to these devices. As a result, The cardiovascular devices market is poised for substantial growth. This growth is driven by the urgent need to manage and treat cardiovascular conditions effectively.

Increasing Health Awareness Among the Population

There is a growing awareness of cardiovascular health among the Chinese population, which is driving the cardiovascular devices market. Educational campaigns and health initiatives have led to a better understanding of the risks associated with cardiovascular diseases. As individuals become more health-conscious, they are more likely to seek preventive measures and treatments, including the use of advanced cardiovascular devices. This trend is further supported by the rise of digital health platforms that provide information and resources related to cardiovascular health. Consequently, the cardiovascular devices market is expected to benefit from this heightened awareness, as more individuals seek out innovative solutions for managing their cardiovascular health.