Growing Fitness Industry

The expansion of the fitness industry in China significantly influences the body composition-analyzers market. With a surge in fitness centers, gyms, and wellness programs, there is a heightened demand for tools that assist in tracking fitness progress. Body composition analyzers are increasingly integrated into fitness facilities, allowing trainers and clients to assess body metrics accurately. The fitness industry in China is projected to reach a market size of approximately $30 billion by 2026, which could further drive the adoption of body composition analyzers. This trend suggests that as more individuals engage in fitness activities, the need for precise body composition measurements will continue to rise.

Increasing Obesity Rates

The rising prevalence of obesity in China is a critical driver for the body composition-analyzers market. According to recent health surveys, approximately 30% of the adult population is classified as overweight or obese. This alarming trend has prompted a greater focus on health and fitness, leading to increased demand for body composition analyzers. These devices provide essential insights into body fat, muscle mass, and overall health, enabling individuals to monitor their progress effectively. As the government implements various health initiatives to combat obesity, the body composition-analyzers market is likely to experience substantial growth, with projections indicating a potential market value increase of over $200 million by 2027.

Rising Disposable Income

The increase in disposable income among the Chinese population is positively impacting the body composition-analyzers market. As more individuals attain higher income levels, there is a greater willingness to invest in health and wellness products. Body composition analyzers, which can range from affordable to premium models, are becoming more accessible to a broader audience. Recent data indicates that the average disposable income in urban areas has risen by approximately 8% annually. This trend suggests that consumers are more likely to purchase body composition analyzers as part of their health management strategies, potentially leading to a market growth projection of $100 million by 2026.

Government Health Initiatives

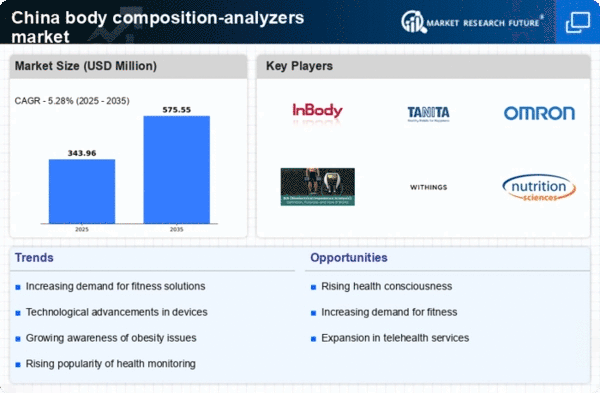

Government initiatives aimed at improving public health are a significant driver for the body composition-analyzers market. In recent years, the Chinese government has launched various campaigns to promote healthy lifestyles and combat chronic diseases. These initiatives often include educational programs that emphasize the importance of monitoring body composition. As a result, there is a growing awareness among the population regarding the benefits of using body composition analyzers. The government's commitment to enhancing health outcomes is likely to stimulate market growth, with estimates suggesting an annual growth rate of 15% in the body composition-analyzers market over the next five years.

Technological Integration in Healthcare

The integration of advanced technology in healthcare is reshaping the body composition-analyzers market. Innovations such as smart devices and mobile applications are enhancing the functionality of body composition analyzers, making them more user-friendly and accessible. In China, the adoption of telehealth and remote monitoring solutions is on the rise, with a reported increase of 40% in telehealth services over the past year. This technological shift encourages consumers to utilize body composition analyzers as part of their health management routines. As healthcare providers increasingly recommend these devices for monitoring health metrics, the market is expected to expand, potentially reaching a valuation of $150 million by 2025.