Rising Demand for Energy Efficiency

The blockchain in-energy market in China is significantly influenced by the rising demand for energy efficiency. As urbanization accelerates and energy consumption increases, there is a pressing need for innovative solutions to optimize energy use. Blockchain technology offers a decentralized approach to energy management, enabling real-time tracking and verification of energy transactions. This capability could lead to enhanced operational efficiencies, potentially reducing energy waste by up to 30%. Moreover, the integration of smart contracts within blockchain systems may facilitate automated energy trading, further driving efficiency. The growing emphasis on sustainability and cost reduction among consumers and businesses alike is likely to propel the adoption of blockchain solutions in the energy sector.

Increased Investment in Renewable Energy

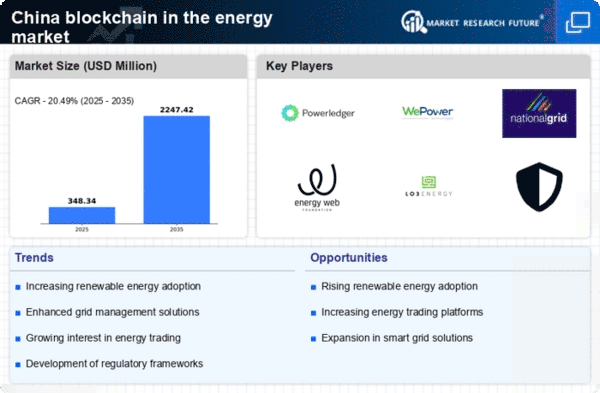

The blockchain in-energy market in China is poised for growth due to increased investment in renewable energy sources. The Chinese government has set ambitious targets for renewable energy, aiming for 20% of total energy consumption to come from non-fossil sources by 2025. This shift is likely to create a favorable environment for blockchain applications, particularly in tracking and trading renewable energy credits. Blockchain technology can enhance transparency and traceability in renewable energy transactions, which may attract more investors. Reports suggest that investments in renewable energy projects could exceed $300 billion by 2030, indicating a substantial opportunity for blockchain integration. As the market evolves, the synergy between blockchain and renewable energy could redefine energy trading dynamics.

Regulatory Support for Blockchain Adoption

The blockchain in-energy market in China is experiencing a surge in regulatory support, which appears to be a crucial driver for its growth. The Chinese government has been actively promoting blockchain technology as part of its broader strategy to enhance energy efficiency and sustainability. Recent policies indicate that the government aims to integrate blockchain solutions into energy trading platforms, potentially streamlining transactions and reducing costs. This regulatory backing may lead to increased investment in blockchain projects, with estimates suggesting that the market could reach a valuation of $1 billion by 2027. Furthermore, the alignment of blockchain initiatives with national energy goals could foster a more robust ecosystem, encouraging innovation and collaboration among stakeholders.

Consumer Empowerment through Decentralization

The blockchain in-energy market in China is increasingly characterized by consumer empowerment through decentralization. As consumers become more aware of their energy consumption patterns, there is a growing interest in decentralized energy solutions. Blockchain technology enables peer-to-peer energy trading, allowing consumers to buy and sell energy directly, which could lead to more competitive pricing. This shift may also encourage the adoption of renewable energy sources, as consumers seek to generate their own energy. The potential for consumers to participate actively in the energy market could reshape traditional utility models, fostering a more resilient and responsive energy ecosystem. The trend towards decentralization is likely to gain momentum as technological advancements continue to emerge.

Technological Advancements in Blockchain Solutions

The blockchain in-energy market in China is being propelled by rapid technological advancements in blockchain solutions. Innovations in scalability, interoperability, and security are enhancing the feasibility of blockchain applications in the energy sector. These advancements may facilitate the development of more sophisticated energy management systems, capable of handling large volumes of transactions efficiently. Furthermore, the integration of artificial intelligence and machine learning with blockchain technology could lead to smarter energy trading platforms, optimizing supply and demand dynamics. As these technologies mature, they are likely to attract more stakeholders to the blockchain in-energy market, potentially increasing market participation and investment. The ongoing evolution of blockchain technology could redefine operational frameworks within the energy sector.