Government Regulations

Government regulations significantly influence the china automotive horn systems market. The Chinese government has implemented stringent noise pollution control measures, mandating that automotive horns comply with specific sound level requirements. These regulations aim to mitigate noise pollution in urban areas, thereby enhancing the quality of life for residents. As a result, manufacturers are compelled to innovate and develop horn systems that not only meet these regulatory standards but also provide superior performance. Furthermore, the government's push for electric vehicles (EVs) has led to the establishment of new guidelines for horn systems in EVs, which often require different sound profiles compared to traditional vehicles. This regulatory landscape creates both challenges and opportunities for manufacturers, as they must adapt to evolving standards while also catering to the growing demand for environmentally friendly vehicles.

Rising Vehicle Production

The growth in vehicle production in China is a primary driver for the china automotive horn systems market. In recent years, the country has maintained its position as the largest automobile manufacturer globally, producing over 25 million vehicles annually. This surge in production directly correlates with an increased demand for automotive components, including horn systems. As manufacturers strive to enhance vehicle safety and compliance with noise regulations, the integration of advanced horn systems becomes essential. Furthermore, the expansion of electric vehicles (EVs) in China, which is projected to reach 20% of total vehicle sales by 2025, also necessitates the development of specialized horn systems tailored for these vehicles. Thus, the rising vehicle production in China significantly propels the growth of the automotive horn systems market.

Technological Innovations

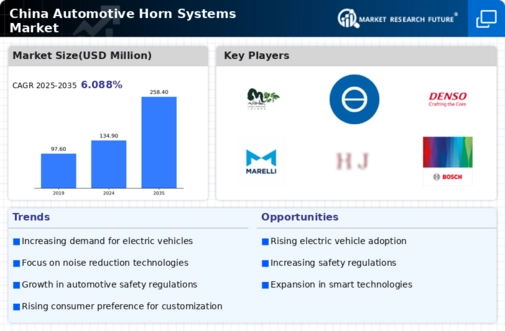

Technological advancements play a crucial role in shaping the china automotive horn systems market. The integration of smart technologies, such as electronic horns and sound modulation systems, is becoming increasingly prevalent. These innovations not only enhance the functionality of horn systems but also improve safety features in vehicles. For instance, the introduction of adaptive sound systems allows horns to adjust their volume and tone based on the surrounding environment, thereby reducing noise pollution. Additionally, the market is witnessing a shift towards lightweight materials and energy-efficient designs, which align with the broader trends in the automotive sector. As manufacturers invest in research and development to create more sophisticated horn systems, the overall market is expected to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 5% over the next five years.

Expansion of Aftermarket Services

The expansion of aftermarket services is a notable driver for the china automotive horn systems market. As vehicle ownership continues to rise in China, the demand for replacement and upgrade parts, including horn systems, is also increasing. Consumers are increasingly seeking high-quality aftermarket products that offer improved performance and durability. This trend is further supported by the growing awareness of vehicle maintenance and the importance of safety features. Additionally, the rise of e-commerce platforms in China has facilitated easier access to a wide range of automotive components, including horn systems. As a result, manufacturers and suppliers are focusing on enhancing their aftermarket offerings to capture this growing segment of the market. The potential for growth in the aftermarket sector is substantial, with estimates suggesting that it could account for a significant portion of the overall automotive horn systems market in the coming years.

Consumer Preferences for Safety Features

Consumer preferences are increasingly driving the china automotive horn systems market, particularly regarding safety features. As awareness of road safety rises, consumers are more inclined to choose vehicles equipped with advanced horn systems that enhance safety. Features such as multi-tone horns and integrated warning systems are becoming popular among buyers, as they provide better auditory signals in critical situations. Additionally, the growing trend of urbanization in China has led to increased traffic congestion, making effective communication on the road more vital. Consequently, manufacturers are responding to these consumer demands by developing innovative horn systems that not only comply with safety regulations but also offer enhanced functionality. This shift in consumer preferences is expected to sustain the growth of the automotive horn systems market, as manufacturers strive to meet the evolving needs of the market.