Rapid Digital Transformation

The rapid digital transformation in China is a pivotal driver for the applied AI finance market. With the increasing adoption of digital technologies, financial institutions are leveraging AI to enhance operational efficiency and customer engagement. According to recent statistics, over 80 percent of Chinese banks have integrated AI into their operations, indicating a strong trend towards automation and data-driven decision-making. This transformation is not only reshaping traditional banking practices but also fostering the emergence of fintech startups that utilize AI for innovative financial solutions. The China applied AI finance market is thus witnessing a surge in demand for AI-driven tools that facilitate real-time analytics, fraud detection, and personalized customer experiences, ultimately leading to improved financial services.

Increased Focus on Cybersecurity

The increased focus on cybersecurity is emerging as a critical driver for the applied AI finance market in China. As financial institutions adopt AI technologies, the need for robust cybersecurity measures becomes paramount to protect sensitive data and maintain customer trust. The Chinese government has recognized this challenge and is actively promoting the development of AI-driven cybersecurity solutions. In 2025, the cybersecurity market in China is expected to exceed 30 billion USD, with a substantial portion allocated to AI applications. This emphasis on cybersecurity not only safeguards financial transactions but also enhances the overall integrity of the China applied AI finance market, encouraging further investment in AI technologies.

Government Support and Investment

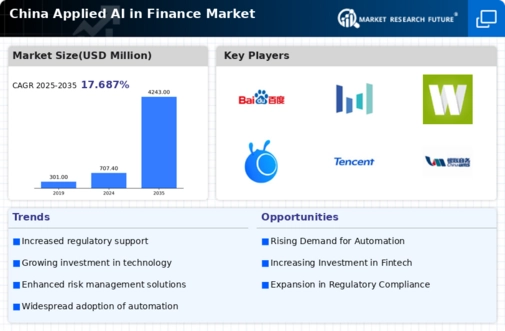

Government support and investment play a crucial role in propelling the applied AI finance market in China. The Chinese government has implemented various policies aimed at promoting AI technologies, including the 'New Generation Artificial Intelligence Development Plan' which emphasizes the integration of AI in finance. In 2025, the government allocated approximately 15 billion USD to support AI research and development, with a significant portion directed towards financial applications. This backing not only encourages innovation but also attracts private investments, creating a conducive environment for AI startups and established financial institutions to collaborate. Consequently, the China applied AI finance market is expected to expand rapidly, driven by enhanced funding and a favorable regulatory landscape.

Enhanced Data Analytics Capabilities

Enhanced data analytics capabilities are driving the growth of the applied AI finance market in China. Financial institutions are increasingly recognizing the value of big data and AI in deriving actionable insights from vast amounts of financial data. By employing advanced analytics, banks can better understand customer behavior, assess credit risk, and optimize investment strategies. Reports suggest that the market for AI-driven data analytics in finance is projected to reach 10 billion USD by 2027 in China. This trend is encouraging financial organizations to invest in AI technologies that improve their analytical capabilities, thereby fostering innovation within the China applied AI finance market.

Growing Consumer Demand for Fintech Solutions

The growing consumer demand for fintech solutions is a significant driver of the applied AI finance market in China. As consumers increasingly seek convenient and efficient financial services, fintech companies are responding by integrating AI technologies to meet these expectations. Recent surveys indicate that over 70 percent of Chinese consumers prefer using AI-powered financial applications for tasks such as budgeting, investment, and loan management. This shift in consumer behavior is prompting traditional banks to adopt AI solutions to remain competitive. The China applied AI finance market is thus experiencing a transformation, with a focus on developing user-friendly platforms that leverage AI for enhanced customer experiences and tailored financial products.