Expansion of Smart Devices

The proliferation of smart devices in China is significantly influencing the affective computing market. With the increasing integration of AI and emotion recognition technologies into smartphones, wearables, and home automation systems, consumers are becoming more accustomed to interacting with emotionally aware devices. This trend is expected to drive the market as manufacturers seek to differentiate their products through enhanced emotional intelligence features. By 2025, the number of smart devices in China is projected to exceed 1 billion, creating vast opportunities for affective computing applications. As consumers demand more intuitive and responsive technology, the affective computing market is likely to experience substantial growth.

Technological Advancements in AI

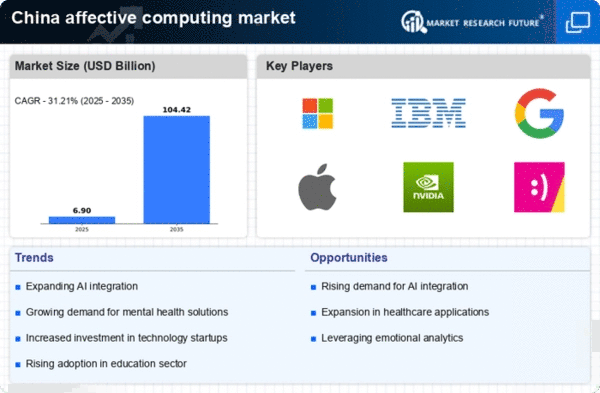

The rapid evolution of artificial intelligence (AI) technologies is a primary driver for the affective computing market in China. Innovations in machine learning and natural language processing enable systems to better understand and interpret human emotions. This capability is increasingly being integrated into various applications, including customer service and mental health support. The market for AI in China is projected to reach approximately $150 billion by 2025, indicating a robust growth trajectory. As businesses recognize the value of emotional intelligence in enhancing user experience, the demand for affective computing solutions is likely to surge. This trend suggests that companies investing in AI-driven emotional analytics will gain a competitive edge, thereby propelling the affective computing market forward.

Regulatory Support for AI Innovations

The Chinese government is actively promoting the development of AI technologies, which includes support for the affective computing market. Policies aimed at fostering innovation and research in AI are being implemented, creating a favorable environment for companies to develop and deploy affective computing solutions. This regulatory support is expected to enhance collaboration between academia and industry, leading to advancements in emotional analytics and user experience design. As the government invests in AI infrastructure, the affective computing market is likely to benefit from increased funding and resources. This supportive landscape may result in a market growth rate of around 15% annually, reflecting the potential for innovation and application in various sectors.

Growing Demand for Emotion Recognition

There is a notable increase in the demand for emotion recognition technologies within the affective computing market in China. Industries such as retail, automotive, and entertainment are increasingly adopting these technologies to enhance customer engagement and satisfaction. For instance, emotion recognition systems can analyze facial expressions and voice tones to gauge customer reactions in real-time. This capability allows businesses to tailor their offerings and improve service delivery. The market for emotion recognition is expected to grow at a CAGR of around 25% through 2025, reflecting the rising importance of understanding consumer emotions. As companies strive to create more personalized experiences, the affective computing market is poised for significant expansion.

Increased Investment in Mental Health Solutions

The growing awareness of mental health issues in China is driving investment in affective computing solutions aimed at providing support and intervention. Technologies that can assess emotional states and provide feedback are becoming essential tools in mental health care. The Chinese government has recognized the importance of mental health, allocating substantial resources to improve mental health services. This focus is likely to result in a market growth rate of approximately 20% annually for affective computing applications in mental health by 2025. As more individuals seek accessible mental health resources, the affective computing market is expected to play a crucial role in delivering innovative solutions.