Emphasis on Enhanced Customer Experience

In the competitive landscape of China, businesses are placing a strong emphasis on enhancing customer experience, which serves as a significant driver for the advanced analytics market. Companies are utilizing advanced analytics to gain insights into customer behavior, preferences, and trends, enabling them to tailor their offerings accordingly. This focus on personalization is evident in sectors such as e-commerce and hospitality, where organizations are investing heavily in analytics tools to improve customer engagement. It is estimated that companies leveraging advanced analytics for customer experience improvements can achieve revenue growth of up to 15%. As a result, the advanced analytics market is likely to see continued growth as businesses prioritize customer-centric strategies.

Growing Investment in Smart Technologies

Investment in smart technologies is a key driver of the advanced analytics market in China. With the rise of the Internet of Things (IoT) and smart devices, organizations are generating unprecedented volumes of data. This influx of data necessitates advanced analytics solutions to extract meaningful insights and optimize operations. The Chinese government has been actively promoting smart city initiatives, which are expected to attract investments exceeding $300 billion by 2025. As businesses seek to capitalize on these opportunities, the demand for advanced analytics tools that can process and analyze IoT data is likely to increase, thereby propelling the advanced analytics market.

Regulatory Compliance and Risk Management

The advanced analytics market in China is shaped by the increasing need for regulatory compliance and effective risk management. As industries face stringent regulations, particularly in finance and healthcare, organizations are turning to advanced analytics to ensure compliance and mitigate risks. The ability to analyze large datasets for compliance purposes is becoming essential, as non-compliance can result in substantial financial penalties. Furthermore, the market for risk management solutions is projected to grow significantly, with estimates suggesting a CAGR of around 20% through 2025. This trend indicates that businesses are likely to invest in advanced analytics tools to enhance their risk assessment capabilities, thereby driving growth in the advanced analytics market.

Expansion of Cloud Computing Infrastructure

The advanced analytics market in China is significantly influenced by the rapid expansion of cloud computing. As businesses increasingly migrate to cloud-based solutions, they gain access to scalable and flexible analytics tools that facilitate real-time data processing and analysis. This transition allows organizations to harness the power of big data without the burden of extensive on-premises hardware. Reports indicate that the cloud services market in China is expected to reach $100 billion by 2025, further fueling the growth of the advanced analytics market. The integration of cloud technologies enables companies to deploy advanced analytics solutions more efficiently, thereby enhancing their ability to derive insights and drive innovation.

Rising Demand for Data-Driven Decision Making

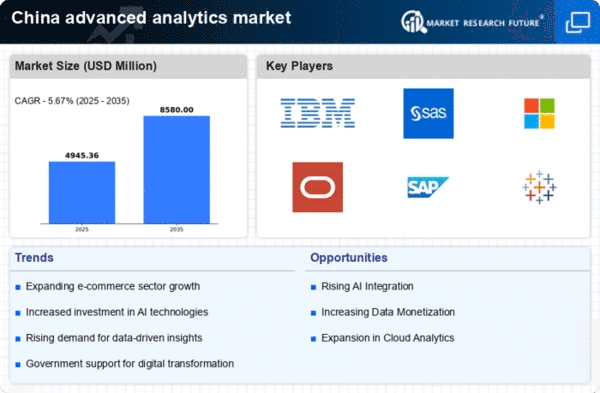

The advanced analytics market in China is experiencing a notable surge in demand as organizations recognize the value of data-driven decision making. Companies across various sectors, including finance, healthcare, and retail, are leveraging advanced analytics to enhance operational efficiency and improve customer experiences. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is driven by the need for actionable insights derived from vast amounts of data, enabling businesses to make informed strategic choices. As organizations strive to remain competitive, the adoption of advanced analytics tools becomes essential, thereby propelling the advanced analytics market forward.