Social Media Influence

The action camera market in China is significantly influenced by rising social media platforms. As users increasingly share their experiences online, the demand for high-quality video content surges. In 2025, it is estimated that over 60% of action camera users in China utilize their devices primarily for social media content creation. This trend encourages manufacturers to develop cameras with advanced connectivity features, enabling seamless sharing and editing. The integration of user-friendly interfaces and editing software may also become a focal point for brands aiming to capture the attention of tech-savvy consumers. Consequently, the action camera market is likely to see a shift towards products that enhance the social media experience.

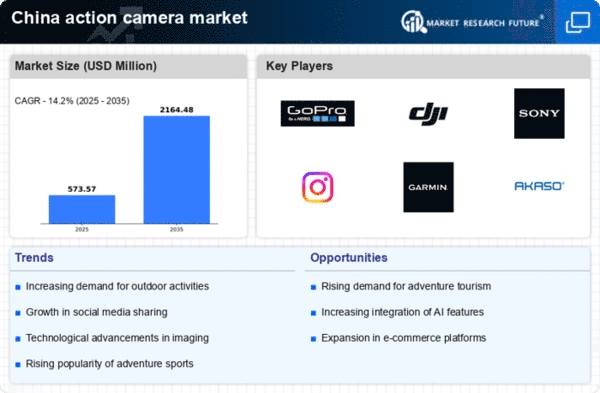

Rising Adventure Tourism

The The action camera market in China is experiencing a notable boost due to the increasing popularity of adventure tourism. As more individuals engage in activities such as hiking, skiing, and mountain biking, the demand for action cameras rises. In 2025, the adventure tourism sector in China is projected to grow by approximately 15%, leading to a corresponding increase in action camera sales. Consumers seek durable and high-quality cameras to capture their experiences, which drives innovation within the action camera market. This trend suggests that manufacturers may focus on enhancing features such as waterproofing and shock resistance to cater to the adventurous spirit of consumers.

Enhanced Consumer Awareness

Consumer awareness regarding the capabilities and benefits of action cameras is on the rise in China. As more individuals become informed about the features and advantages of these devices, the action camera market is likely to expand. Educational campaigns and influencer marketing play a crucial role in this trend, as they help demystify the technology and showcase its potential. In 2025, it is anticipated that consumer knowledge will lead to a 20% increase in action camera sales, as more people recognize the value of capturing high-quality footage during their activities. This heightened awareness may prompt manufacturers to focus on user education and product demonstrations to further stimulate market growth.

Growing E-commerce Adoption

The action camera market in China is benefiting from the rapid growth of e-commerce platforms. With an increasing number of consumers preferring online shopping, the accessibility of action cameras has improved significantly. In 2025, e-commerce sales in the electronics sector are expected to account for over 30% of total sales, providing a substantial boost to the action camera market. This shift encourages manufacturers to invest in online marketing strategies and partnerships with e-commerce platforms to reach a broader audience. Additionally, the convenience of online shopping allows consumers to compare products easily, fostering competition among brands and potentially leading to better pricing and innovation in the action camera market.

Technological Integration in Sports

The action camera market in China is set for growth due to the integration of technology in various sports. As sports organizations and athletes adopt action cameras for training and performance analysis, the demand for these devices increases. In 2025, it is projected that the use of action cameras in professional sports will rise by 25%, as coaches and athletes seek to leverage video analysis for performance improvement. This trend indicates that manufacturers may prioritize features such as high-resolution video and advanced stabilization technology to meet the needs of sports professionals. Consequently, the action camera market is likely to evolve, catering to a more specialized audience.