North America : Market Leader in Testing Services

North America continues to lead the global market for chemical analysis and testing services, holding a significant market share of 9.25 in 2024. The region's growth is driven by stringent regulatory requirements, increasing demand for quality assurance, and advancements in analytical technologies. The presence of major industries such as pharmaceuticals, food and beverage, and environmental services further fuels this demand, making it a critical hub for testing services.

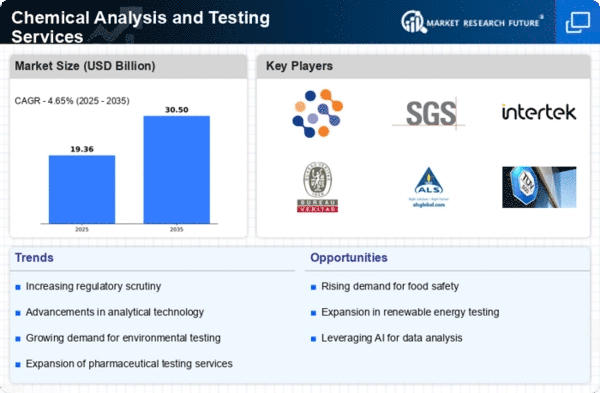

The competitive landscape in North America is characterized by key players like Eurofins Scientific, SGS SA, and Intertek Group plc, which dominate the market. The U.S. is the largest contributor, supported by a robust regulatory framework that emphasizes safety and compliance. As companies increasingly focus on sustainability and innovation, the demand for comprehensive testing services is expected to rise, solidifying North America's position as a market leader.

Europe : Regulatory Framework Drives Growth

Europe's chemical analysis and testing services market is projected to grow significantly, with a market size of 5.5 in 2024. The region benefits from a strong regulatory framework that mandates rigorous testing and compliance, particularly in sectors like pharmaceuticals and food safety. The increasing focus on environmental sustainability and consumer safety is driving demand for advanced testing services, making Europe a key player in the global market.

Leading countries such as Germany, France, and the UK are at the forefront of this growth, hosting major players like Bureau Veritas and TÜV SÜD AG. The competitive landscape is marked by innovation and collaboration among companies to meet evolving regulatory standards. As the market continues to expand, the emphasis on quality and compliance will remain paramount, ensuring Europe's pivotal role in the global testing services arena.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region is witnessing rapid growth in chemical analysis and testing services, with a market size of 3.5 in 2024. This growth is driven by increasing industrialization, rising consumer awareness regarding product safety, and stringent regulatory requirements. Countries like China and India are leading this trend, as they enhance their regulatory frameworks to ensure compliance with international standards, thereby boosting demand for testing services.

The competitive landscape is evolving, with both local and international players vying for market share. Companies such as ALS Limited and Merieux Nutrisciences are expanding their operations in the region to capitalize on the growing demand. As the market matures, the focus on quality assurance and technological advancements will play a crucial role in shaping the future of testing services in Asia-Pacific.

Middle East and Africa : Developing Market Opportunities

The Middle East and Africa region is gradually emerging in the chemical analysis and testing services market, with a market size of 0.25 in 2024. The growth is primarily driven by increasing industrial activities, particularly in oil and gas, and a growing emphasis on environmental regulations. Governments are beginning to implement stricter compliance measures, which is expected to enhance the demand for testing services in the coming years.

Countries like South Africa and the UAE are leading the charge, with investments in infrastructure and regulatory frameworks to support the testing services sector. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region continues to evolve, the focus on quality and compliance will be essential for growth in the testing services market.