North America : Market Leader in Performance Analysis

North America is poised to maintain its leadership in the Building Performance Analysis and Consulting Services market, holding a significant market share of $4.25B in 2025. Key growth drivers include stringent building regulations, increasing demand for energy-efficient solutions, and a focus on sustainability. The region's robust infrastructure investments and technological advancements further catalyze market expansion, making it a hub for innovative building practices.

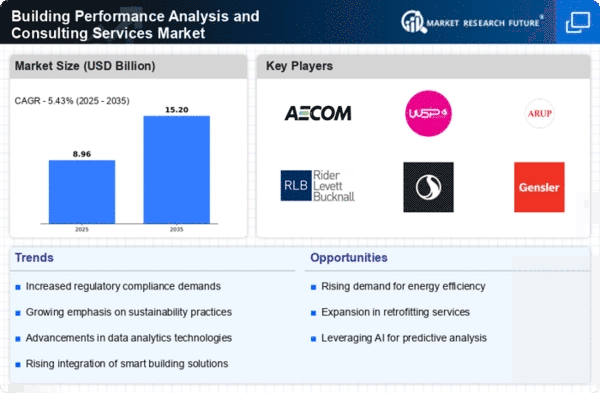

The competitive landscape is characterized by major players such as AECOM, WSP Global, and Jacobs Engineering, which dominate the market with their extensive service offerings. The U.S. and Canada are the leading countries, benefiting from a high level of investment in smart building technologies and consulting services. This competitive environment fosters innovation and enhances service delivery, ensuring that North America remains at the forefront of the industry.

Europe : Emerging Trends in Sustainability

Europe's Building Performance Analysis and Consulting Services market is projected to reach $2.8B by 2025, driven by a strong emphasis on sustainability and energy efficiency. Regulatory frameworks such as the EU's Green Deal and various national initiatives are pivotal in shaping demand trends. The region's commitment to reducing carbon emissions and enhancing building performance is a key catalyst for market growth, attracting investments in innovative technologies and consulting services.

Leading countries in this region include Germany, the UK, and France, where firms like Arup Group and Rider Levett Bucknall are making significant strides. The competitive landscape is marked by a mix of established players and emerging firms, all vying to meet the growing demand for sustainable building solutions. This dynamic environment fosters collaboration and innovation, positioning Europe as a leader in building performance consulting.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing rapid growth in the Building Performance Analysis and Consulting Services market, projected to reach $1.8B by 2025. Key drivers include urbanization, increasing construction activities, and a rising awareness of energy efficiency. Governments are implementing supportive policies and regulations to enhance building performance, which is further fueling market demand. The region's diverse economic landscape presents unique opportunities for growth in various countries.

Countries like China, India, and Australia are leading the charge, with significant investments in infrastructure and smart building technologies. The competitive landscape features both local and international players, including Gensler and Stantec, who are adapting to regional demands. This competitive environment encourages innovation and the adoption of advanced consulting services, positioning Asia-Pacific as a burgeoning market for building performance analysis.

Middle East and Africa : Emerging Market with Growth Potential

The Middle East and Africa (MEA) region is gradually emerging in the Building Performance Analysis and Consulting Services market, with a projected size of $0.65B by 2025. Key growth drivers include rapid urbanization, infrastructure development, and increasing investments in sustainable building practices. Governments are recognizing the importance of building performance in achieving economic growth and are implementing regulations to support this transition, creating a favorable environment for consulting services.

Leading countries in this region include the UAE and South Africa, where significant projects are underway to enhance building efficiency. The competitive landscape is evolving, with both local firms and international players seeking to establish a foothold. Companies like Tetra Tech are expanding their presence, contributing to the region's growth and innovation in building performance analysis.